First, let's note that I'm only using 416 data for Toronto, not GTA-wide numbers. You will find the full presentation (including additional charts and analysis, and without the image distortion this website adds) here or on SlideShare here.

Toronto Real Estate holding its own in recent years

For any time period you look back in recent years, Toronto real estate has been a strong performer with returns in the 10% to 17% range. It has looked much better than the TSX (except the TSX was slightly higher in the last year), and is holding up well when we look at US market returns (the S&P 500) and internationally (MSCI World Index).

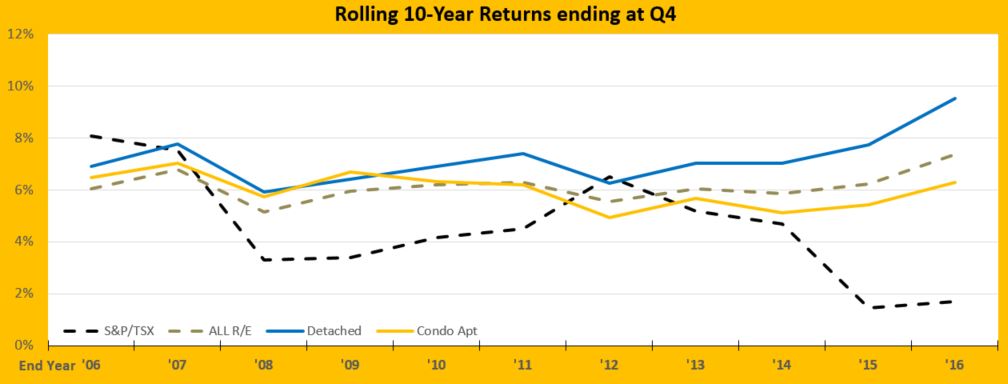

Toronto Real Estate has owned the long term

Taking a longer term view, you'll see that all of the 10-year-plus views show Toronto real estate as having the strongest returns. And the 5-year return of 8.5% isn't too shabby either! Long term, a portfolio of Toronto houses and condos has delivered around 7%, whereas the different stock market indexes have been around 5%. Canadian inflation in this period has generally ranged from 0.8% to 2.6% (with two outlying years, 2000 at 3.2% and 2002 at 3.8%).

Detached housing outshines condos

The average price of a detached house in the 416 grew $271k last year. They aren't making any new land in the city! In the downtown areas, any new development you see that isn't high rise condos are at least townhouses, as developers try to maximize how many homes they can fit in the expensive land they just bought. If a new house is being built, chances are it's a tear-down and no net housing supply is being created. Demand for houses is increasing as Toronto experiences positive net migration, plus you have hordes of downtown people that have lived close to the action most of their adult lives and then get married and have kids and want more space but don't want to give up their downtown lifestyles. And you're coupling that with a fixed supply of detached homes. So I believe we'll see continued upward pressure on detached homes — not at the rate of 26% like 2016's increase. You have to go all the way back to a 9-year view to find an average annual return less than 10% for detached houses (8.8%).

The more recent the time period, the more divergent the detached house (currently 30% of GTA transactions) and condo apartments (currently 51%) become. I think it will stay this way for awhile.

Detached housing wins in the end

In this rolling 10-year view, you can see that detached houses have been the top Canadian performer in 8 of the 11 periods (the 2016 numbers match the 10 year numbers in the chart above). In only one of those 10-year periods have condo apartments topped detached houses. You can see the gap between detached and condo returns widening, which I think will be the way forward for awhile now.

Three for the road

1) Real estate out-performed the TSX Composite Index over most every measure in this 20-year view (of course noting that past performance does not guarantee future results)

2) Detached houses significantly out-performed Condo apartments in these periods. My belief is that the fixed supply in the 416 will keep this trend going for the foreseeable future. The other reason I believe this is that the condo market has a much higher percentage of "investors" owning stock. Whenever a correction/pull-back/crash hits, those unit holders will be the first to rush to cash out (raising the supply). I think houses are much more sheltered from a crash since everybody lives in their homes for the most part. The only sellers would be those that want to cash out and move to the suburbs or further afield to a cheaper market. Those people may exist, but not in the numbers that condo investors do.

3) Average 416 detached house prices grew more last year ($271K) than the average condo has in 15 years. And that increase is actually equal to the average house price 20 years ago. Wild stuff.

That statistic isn't in the charts above. To see the rest of the charts and further insights here or on SlideShare here.

If you have any comments or statistic requests, feel free to let me know via Twitter or email.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment