This post has been "on my list" for a long time. I've had a few clients ask me recently about pre-construction and the first thing I tell them is they need to be aware of the risks. Today I want to lay out a dozen of those risks for you. I've written this point with condominium apartments in mind, but most of the points apply to condo townhouses as well as pre-con freehold houses too.

Photo source: globalnews.ca

1) Cancellation

This is the risk the condo you plunked down a big deposit on won't even get built. According to a recent Globe & Mail article, there have been 6,350 canceled condominium units in the GTA since 2017. According to stats in this article, 3%-5% of condo projects don't get completed. Going back to 2012 there have been 23 project cancellations "in the city" according to the same article.

Canceled projects include Cosmos up by the Vaughan Metropolitan Centre, The Bean near Dufferin and Eglinton, DIAM on the Danforth, and Museum Flats near the new Museum of Contemporary Art in the Bloor and Lansdowne area. Sometimes the building gets built but some unitholders have their places canceled, like this Brad Lamb project called Wellington House which got scaled back from 23 levels to 17 with floorplates being altered too. The most common reason for cancellations used to be lack of sales, but more and more commonly it's due to escalating construction costs. Developers sell at one time based on certain cost assumptions. It is common for Toronto developers to begin selling pre-construction condos before having planning approval (which I think should be outlawed, but that's for another blog post). Here's a quote from an October 2018 Globe article: "According to condo-market analysis firm Urbanation Inc., fewer than half of the 32,435 apartments offered for preconstruction sales in 2017 had full approvals attached."

So they sell the units then time passes and construction costs and development costs have risen sharply and the project economics no longer make sense and they have a hard time getting financing. (Cynics also point out that developers can sell for way at new prices per square foot.) The risk in the cancellation is that the market passes you by, and condos certainly had high price appreciation in 2016 through 2018. I previously did some calculations on Museum FLTS to see how much the opportunity cost hurt purchasers. Though the purchasers got their money refunded, but in 18 months of having their money tied up, I estimated they fell $90,000 behind the market (probably more than that because I was using 416 average condo prices and I think this building was more expensive).

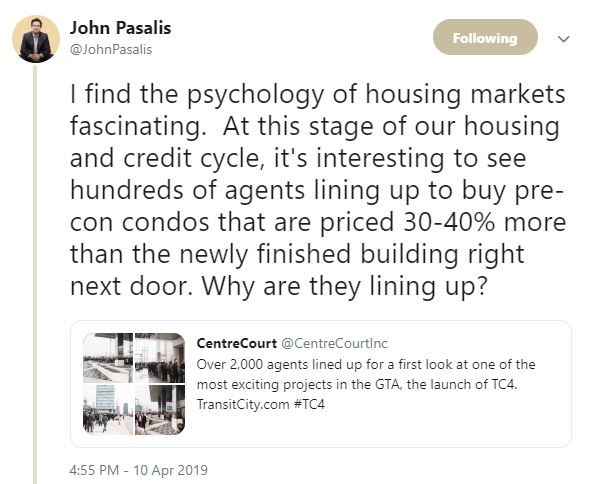

2) Price premiums

The way you get burned in cancellation risk is from rising prices. But it's also possible to get burned by falling prices, as Vancouver is experiencing right now. It used to be that pre-construction condos were priced at a discount because of all the risks the buyer was taking. Now it's the opposite.

I know of one project on Bloor priced at $1230 per square foot (PSF) while there is a three-year-old Tridel building across the street with a $945 PSF price in the last 365 days and its sister building beside it was at $943 PSF. That's a 30% premium. Granted the new one has very nice finishes, but for a $285 PSF difference, you can buy yourself a heckuva lot of upgraded finishes if you bought the old one and remodeled. (That's $171K on 600 sqft or $285K on 1000 sqft.)

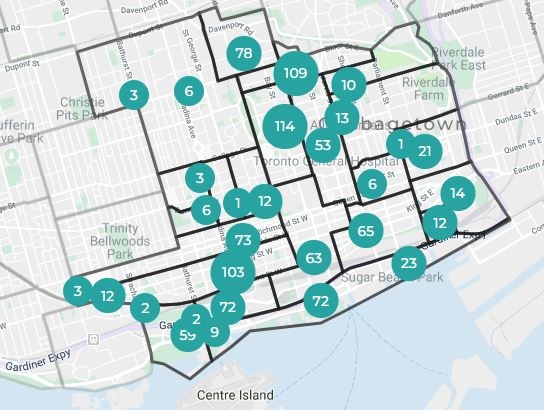

Urbanation in a recent report listed asking prices for available units on the market in Q1 2019 at $1279 PSF, up 13% from a year ago. Condos.ca is showing an average sales price of $971 PSF for 2019 for what they call Downtown (which may not line up with Urbanation's definition, I'm unsure, but should have strong overlap). Here's the Condos.ca map, FWIW:

So $1279 over $971 is a 32% premium for pre-con. That's three examples around the 30% premium mark. People are basically gambling that recent double-digit growth in condo prices will continue for the next few years to justify their overpay. Per my April monthly market stats, the 5-year CAGR on average 416 condo prices is 10.33%. But that was as low as 3.75% as recently as March 2016. And the 20 year is currently at 6.98%. Regression to the mean will happen with condo price appreciation. So the risk here is that you buy this place and when it's finally built 3 years from now, the price of the building across the street is cheaper than yours. Buyers won't care what you paid for your unit, they only care what it's worth now when they're buying.

A related risk is pointed out in this Steve Saretsky tweet. Appraisals could be a problem when you complete. The bank appraiser will look at that building across the street with a sales history, and also doesn't care what you paid for the place but is worried about what it's worth. The problem could be you might have trouble obtaining financing on your new unit if the market hasn't caught up to what you speculatively paid, banking on price appreciation.

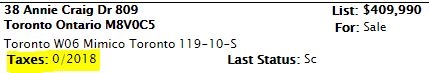

3) Property taxes

Here's a current listing for a Toronto condo under an assignment sale (pre-con purchaser is selling before the building registers). The notes to this one include "Taxes have not been assessed yet," which is a typical wording.

The risk is that the taxes will higher than you budgeted for. The average 416 condo apartment sold for $637,181 in April. I looked at condos that sold for between $630K and $640K so far this year. There were 69 results. The average property tax was $2456 (median was $2450). But that ranged from $1620 to $3200. If you are stretching to afford your condo and you budgeted the median $2450, you're not going to like it if the actual assessment comes and you find out you're paying $750 a year more than you expected. With a re-sale condo, you at least know what you're getting.

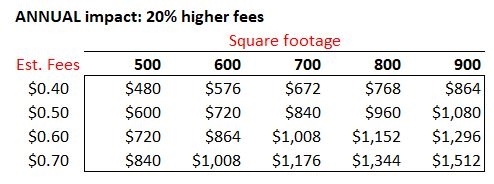

4) Condo fees

The same applies to condo fees, as far as knowing what you're getting. I actually wrote a whole blog post on this before. Basically, when you're in the showroom and the developer is trying to sell you a unit, they tend to lowball the condo fees. My analysis found that the average was low by about 20%. In fairness, costs may rise in the 3-5 years it takes to complete to project, but to me, that should be accounted for in their estimates. There are no repercussions to the developers for underestimating the fees, though, so why not tell you a lower number to help entice you to buy a unit?

If you had a 600 sqft condo and were told $0.60 PSF condo fees, the annual negative impact to you would be $1008. This stuff all adds up.

5) Development fees

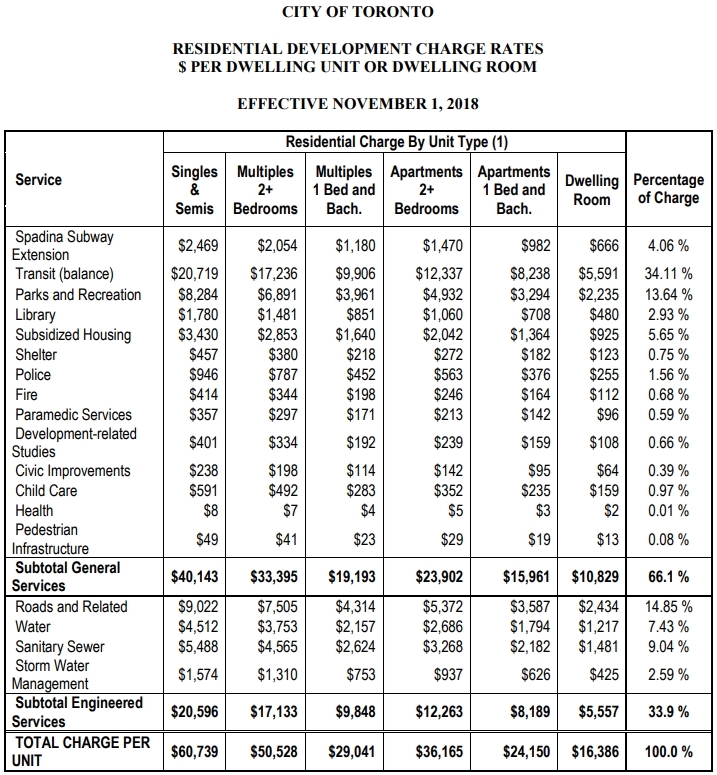

First of all, what are the development charges? Per the City of Toronto's own website, "Development charges are fees imposed on land development and redevelopment projects to help pay for the capital costs of infrastructure that is needed to service new development." The biggest ticket items are transit, roads, and parks & rec, as you can see by the able below (link).

They are charged to the developer and payable to the City before the building permit is issued. The problem is, many GTA condos start selling before they have final approvals, and development charges can change. And do change - sometimes by a lot. See that $60,739 total for a single family home at the bottom left above? Well, back on November 1, 2018, it jumped all the way up from $41,251. And will increase to $71,432 on November 1, 2019, and then to $80,227 on November 1, 2020, as the increase is phased in. That's nearly doubling in 2 years (a $39K increase per home). While inflation (as measured by the CPI) has increased 22% since 2004 and City of Toronto property taxes have increasd by 30%, development charge increases in the GTA are up between 236% and 878% depending on the municipality.

Developers certainly don't want to eat something like that, so their contracts (which are written to heavily favor themselves) write in a language to pass potential increases like that along to the buyers. The time the buyer has to come up with these costs is typically upon closing and you don't want to be caught with a nasty surprise, like these buyers a few years ago. What you want to do to cut down your risk is negotiate a cap on the development charges.

6) Occupancy fees (a.k.a. "phantom rent")

One reason people like to buy is that they don't like the idea of paying rent money that they'll never see again. At least with your mortgage payment, some of that money goes back into your own pocket because you're paying down principal with the interest. Occupancy fees mess that up. What happens is the developer can't transfer over ownership of the units until the building is "registered" and handed over to the newly formed condominium corporation. But some individual units are ready for occupancy before others. Floors are usually finished from lower to higher. It also happens because there can be a backlog of registering buildings.

The developer is still making payments on construction financing and paying municipal property taxes while they're waiting for full ownership to transfer. So between a unit's occupancy date (when it's ready to be lived in) and the closing date (when the building registers and ownership is transferred over to you, you're going to help the developer carry the place. This isn't going towards paying down your mortgage; it's just like rent in that you'll never see it again. The number of months you're stuck paying could be non-existant to very low (especially if you've bought on a higher floor that's last to complete) or I've heard of up to 18 months in extreme cases with construction or paperwork delays. It would be prudent to budget for this.

7) Living in a construction zone

This is directly related to the Interim Occupancy perod described above. While your unit has been deemed livable by the builder, the rest of the building could look like this:

Tarion has a good blog on "what you need to know about interim occupancy" and that's where I grabbed this image. Not all buildings (or all floors of your building) will look as raw as this. But you may very well have to deal with lots of dust and dirt in the common areas, tradespeople coming in and out of the building all day and construction noise, elevators blanketed up, and unavailable amenities. It may not feel too "homey" in this period.

8) Neighbor risk

There are two aspects to this. First is the people next door. If you look at a pre-existing unit, there's a chance you hear their two dogs barking loudly during your visit(s) or catch disagreeable odors wafting out from under their door or on the balcony. Or hear the upstairs' neighbor's dog click-clacking around on the floors and dropping their toys. And if that stuff bothers you, you don't have to buy. With pre-con it's like spinning the bottle and you don't know what you're going to get. To be fair, the chances of a neighbor's offensiveness showing up in the exact 30 or 60 minute period(s) you show up for, is likely small.

The far more important one is the surrounding buildings. This is a much bigger risk in an area with still more room to squeeze buildings into. Just because the building has a nice CN Tower or Lake Ontario view now doesn't mean that empty lot across the street will stay empty forever. Or the lot beside your building that may get a building erected on it one day that cuts into your sunshine. I always like to look at this with my clients, and while it can also be a risk with re-sale condos, at least you can see current development plans when you're contemplating buying so you know what's likely in the next 3-5 years. But if you're not moving into your pre-con for 3 years, especially if it's in a development area, plans can change a lot before you eventually move in. I could also call this view risk, and also with a re-sale you go up in it and what you see is what you get for a view. With a pre-con unit, you're just guessing at what your vantage point will be like.

9) Completion date delays

Your pre-con unit will likely not be ready for you to move into on the target completion date given to you at the sales office. If you're liking the idea of buying so you're not "wasting money" on rent, figure you're going to likely be paying rent for 12 to 18 months longer than you were told. If you're paying $2000 a month in rent for 18 months longer, that's $36K you're not getting back. There are no repercussions to the builder for delaying the project a few times because they build the permission to do that right into the contract you sign with them. I've never seen a study on this, but I'd say the higher the building, the longer higher the risk of a longer delay is, as if you're behind on 300 units versus 100 units, I'd guess it would take longer to dig yourself out. On the flipside, delays will help you save up a larger downpayment if you're living in cheap accommodations, like with your parents, or have really cheap rent.

10) Floor plans and unit size

Your final finished unit may not be as big as you were expecting. If you're looking at a model unit, be aware that they're probably showing you a larger space than the average unit. Plus the model might be in a space with really high ceilings, making it feel larger. But on top of that, there's language in the contract that allows the builder to shrink the units. The Ontario New Home Warranty Program mentions a 2% tolerance. Here's language from the Agreement of Purchase and Sale of the first condo I bought:

"The purchaser acknowledges that the size of the Unit as represented by the sales literature... may differ from measurements made using the Unit boundaries set out in the Declaration. NOTE: Actual usable floor space may vary from the stated floor area."

The last point is made because it is an acceptable practice for total square footage figures to be calculated from outside walls on exterior walls and to the center of a party wall (i.e. half the thickness of the wall between you and your neighbor. When I had plans drawn up on my current house (which is sort of between a semi and a rowhouse), the difference between the building's square footage and the usable square footage (drywall to drywall) for the above ground floors (basement walls were thicker, therefor higher shrinkage) averaged 13%. If you apply 13% shrinkage to a 600 sqft condo it turns into 522 sqft.

Bob Aaron once wrote a good article on this, entitled "House size not guaranteed to buyers." In it, he cheekily says "any similarity between what they believe they are getting and what is actually delivered may be a coincidence. Purchasers are forced to rely on the builder's reputation for delivering what was promised." With a re-sale condominium, there are no leaps of faith required as you see the space right in front of your eyes.

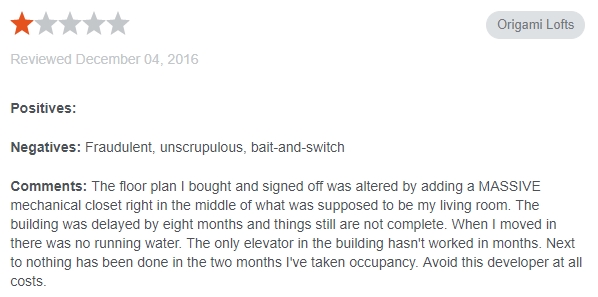

And here's a little something on your floor plans being at risk.

11) Building amenities

The building below at 36 Lisgar ("Edge On Triangle Park") has a "common rooftop deck" between the two towers. Or at least it's supposed to. See how there's nobody in the photo below? That's because, although the building was registered four years ago (April 2015), you're still not allowed to go out there. I reached out to a friend I know in the building and they said "They were going to open it a couple of summers ago but the city didn’t allow them to because of some perceived safety issue (railings not being to code or something). Not sure why it hasn’t been addressed since then."

12) Building finishes

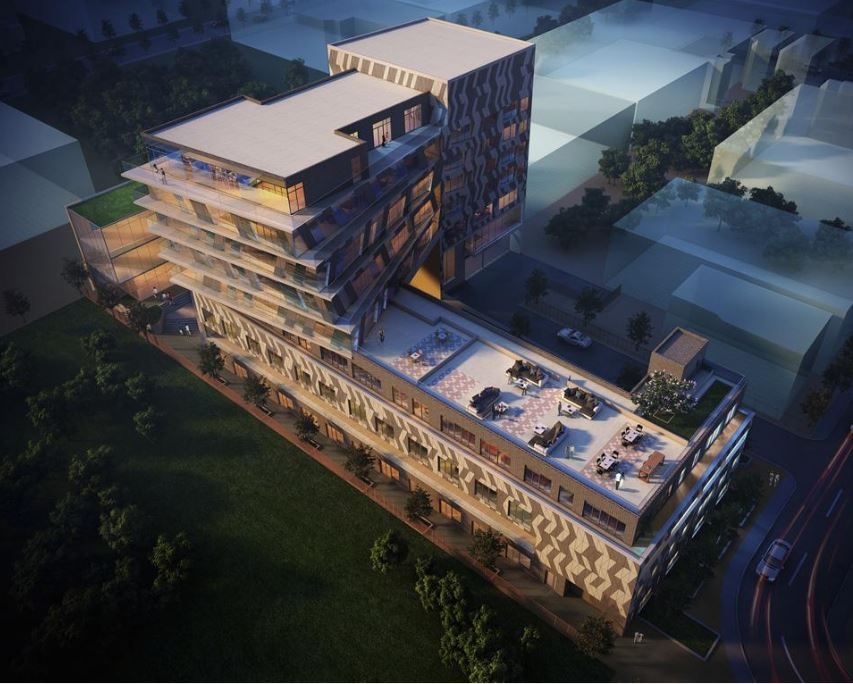

Check out the two photos below of 202 Bathurst (Origami Lofts). Feel free to LOL at the rendering versus actual.

Notice the renderings conveniently leave out the unsightly overhead streetcar wires? The plastic yellow wrap coming down from the streetlamp is missing too. Renderings are fantasy photos, so prepare yourself for some disappointment as the building will end up not looking quite as nice as this ideal view.

Here's a close up I took today of the two planter boxes out front of the building (at least that's what I presume they must be). This is more than 2 years after the completion of the building and they're a real eyesore. You can see the yellow plastic-wrapped wire in here as well. I should've taken a picture of the "lobby"

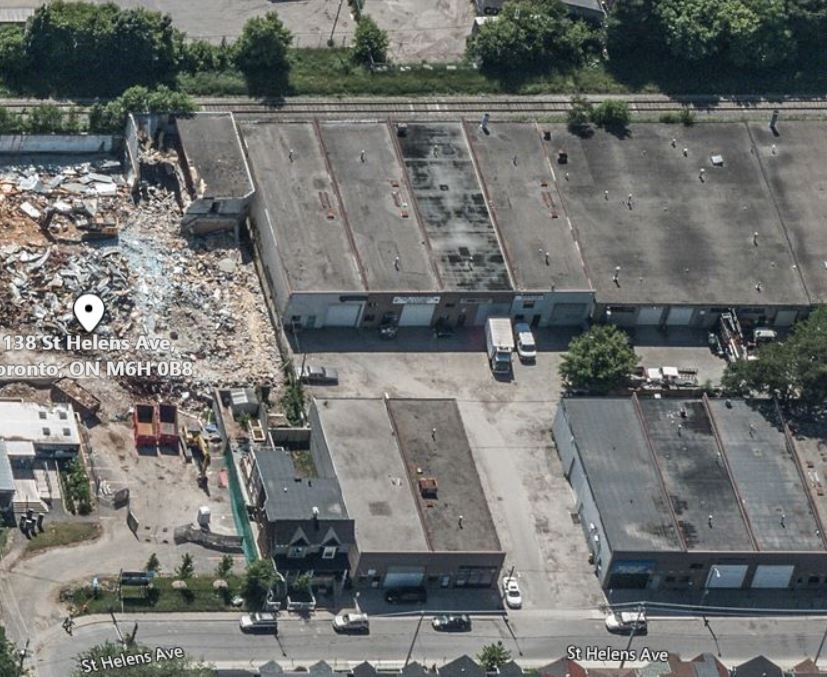

Another one that's a case of not being able to trust the renderings is a project at 138 St. Helens Ave ("Enigma on the Park" in the College & Lansdowne area. Here is an aerial view before construction began. Notice the nice softball field, which is my favourite one in the city as you're nested in among the trees and it has a real outfield fence.

Now here are the project renderings, showing a bunch of people having picnics and strolling around or walking their dogs in what would be the outfield. Also, notice there are no light standards shown here or anything else that gives the impression that this is a permitted sports field.

Here's another rendering. Now there are a bunch of friendly full-grown trees magically in the outfield. Also, note all the trees to the north in the laneways. Now look to the upper left and there's some kind of big lawn with a bunch of trees behind the condo. Scan up two pictures before and note this backs onto a railway actively used by GO Transit, and that the lot behind the condo on the other side of the tracks is actually a big parking lot.

Those laneway trees? That's all driveway for trucks to access all of the industrial buildings right beside the condo. That pavement is are not getting 30 foot high tall trees anytime soon. The blank translucent cube neighbors are business including plumbing suppliers and auto body shops. Now there's a contention among the building owners because the units that are sitting just beyond the outfield fence are getting home runs hit off their facades. To me it's like moving next to the airport and then being surprised by planes flying overhead. Moral: don't rely on renderings - especially external ones.

In summary

Some of the above risks are quantitative and some are qualitative. But a common thread running through them is pre-sale condos have way more unknowns than re-sale, and with those unknowns come risks. With re-sale condos, at least you can see exactly what you're buying. And the considerations that affect your finances, like move-in date, property taxes, maintenance fees, are way more reliable. The reviews page for the developer for Origami Lofts shown above lists several of the risks I mentioned in just two projects (click on the "More" dropdown for owner comments).

My goal is awareness and education. To that point, many people are unaware that you're allowed to bring in a realtor to represent you with a pre-construction purchase. Your realtor will be paid their commission by the developer, but they will be looking out for your best interests and should be offering you guidance on contract terms, current and future developments in the area, comparable sales in the area, and giving you input on the risks that I just listed

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment