The Globe & Mail just ran a large article (subscribers only) on Purplebricks, a budget brokerage that's newer to the Canadian market, as well as a couple of other self-identified disruptors entering the Canadian real estate market. I provided some analysis that I had done for the article, but they just ran a few bits of it, so I thought this would be a good place to share the full numbers I looked at, as well as give some commentary on the article itself.

Photo: Knowledge Source

Newcomers welcome

This extensively researched article quotes representatives of Purplebricks (formerly Comfree), Redfin, Zillow, and Zoocasa, all seen as a bit of the "new guard," while also quoting the CEO of Royal LePage representing the traditional/legacy/old guard. I'm quoted too, and I work for Century 21, so I guess that paints me as the old guard, which I'm a little self-conscious of. So let me just say that I think new competition is a great thing. Think of how much sites like Zillow (launched in 2006) have upped the game with their websites and forced others to follow suit. And different brokerages with their different offerings, from no-frills FSBO (for sale by owner) places to no-frills with some a la carte options (like Purplebricks), to full-service places, consumers like choice and want choice. (Note I'm not lumping all traditional brokerages in as full-service - it really varies from agent to agent how much service they'll provide.)

"Organized real estate" is hardly the unfortunate national oligopoly situation we have with our telco providers and airlines (banks for that matter). With over 54,000 real estate agents as TREB members, real estate across the GTA already has a lot of competition. But as I alluded to earlier, newcomers that bring in desirable new technologies or services force others to elevate their game, and that's a great thing.

Sales analysis - 416 not feeling it

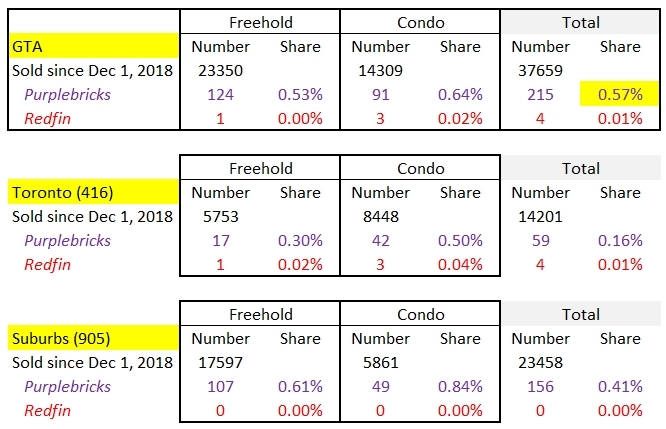

The Globe & Mail article was the cover story of the Report On Business section on Saturday, June 8 (it hit the website the day before). The analysis I had done was up until May 30, and that's what I'm sharing here. The first Purplebricks freehold listing in the GTA (Peel, Halton, York, Durham, Toronto) coincidentally had a contract date of May 30, 2018, so they've been in the market about 1 year. That one sold after 230 days on the market. The first condo listing was as of July 18, 2018 (didn't sell and expired after 242 days).

Redfin launhed a bit later and their first freehold listing had a contract date of February 11, 2019 (didn't sell after 38 DOM and was suspended). Redfin's first condo listing was in the same month, hitting the market on February 27, 2019 (sold after 11 DOM).

So there you have your launch dates. For the Globe piece I picked a December 1 date, so that'd I'd get activity in the nice round number of the last 6 months (so Purplebricks had a bit of a walking lead, but Redfin joined part way through).

Let's not even talk about Redfin because it's so inconsequential. There are three observations I make on these numbers for Purplebricks:

1) Overall we're looking at very small market shares in the GTA (under 0.6%)

2) Penetration in condos is better than freeholds. My hypothesis is that condos are less expensive than freeholds, and to the Royal LePage CEO's point about people being afraid of messing up an important transaction, sellers might be more afraid to use them on a house sale where the stakes are higher. Also, many GTA condos are cookie-cutter and comparable sales are easier to find and figure out sine you may have several similar or even identical units in the same building to point to when figuring out an appropriate price.

3) Toronto penetration is much smaller than in the outlying areas. Purplebricks has sold half the share of freeholds in the 416 (0.3%) than in the outlying 905 portions of the GTA (0.6%). Again this could be due to being more afraid of messing up in the City where the dollar stakes are higher.

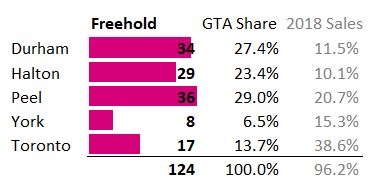

For the 124 total Purplebricks freehold sales in the last 6 months shown above, here is the breakdown by region. The column on the far right is what percentage each region was of TREB's 78K sales in 2018. Check out how Durham, Halton, and Peel have about double the sales as the 416, even though they're much smaller for population and transactions. They're really punching above their weight, while Toronto is just not that into things.

(The 2018 Sales column includes condos and freeholds, so not apples to apples. Toronto's share of these regions' 2018 freehold sales is 25%, so it's still under-represented. Others would gain about 4 or 5% in 2018 freehold sales so are still over-represented, so point is the same. Reason column doesn't add to 100% is that parts of Dufferin and Simcoe make up the other 3.8%.)

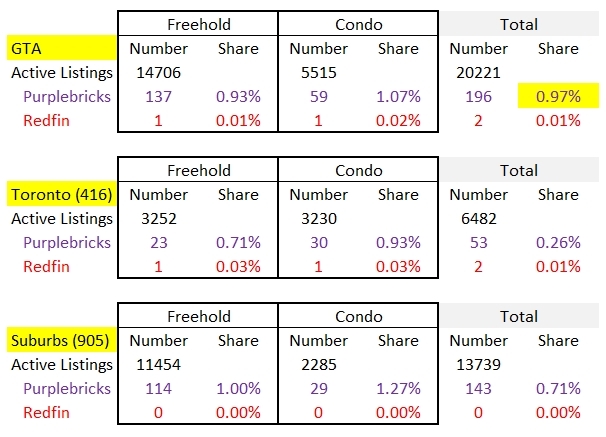

Listings analysis - same story

Here are active listings. It's a snapshot of what was on the MLS on May 30 at around 2 PM.

Observations on this:

1) Purplebricks share is creeping upwards (starting from so low it's hard not to improve), now at just shy of 1% (196 freeholds and condos out of 20,221 total available for sale, as mentioned in the article)

2) People trusting Purplebricks less with houses than with condos in all geographic splits

3) Toronto penetration still behind that of surrounding area

The advertisements

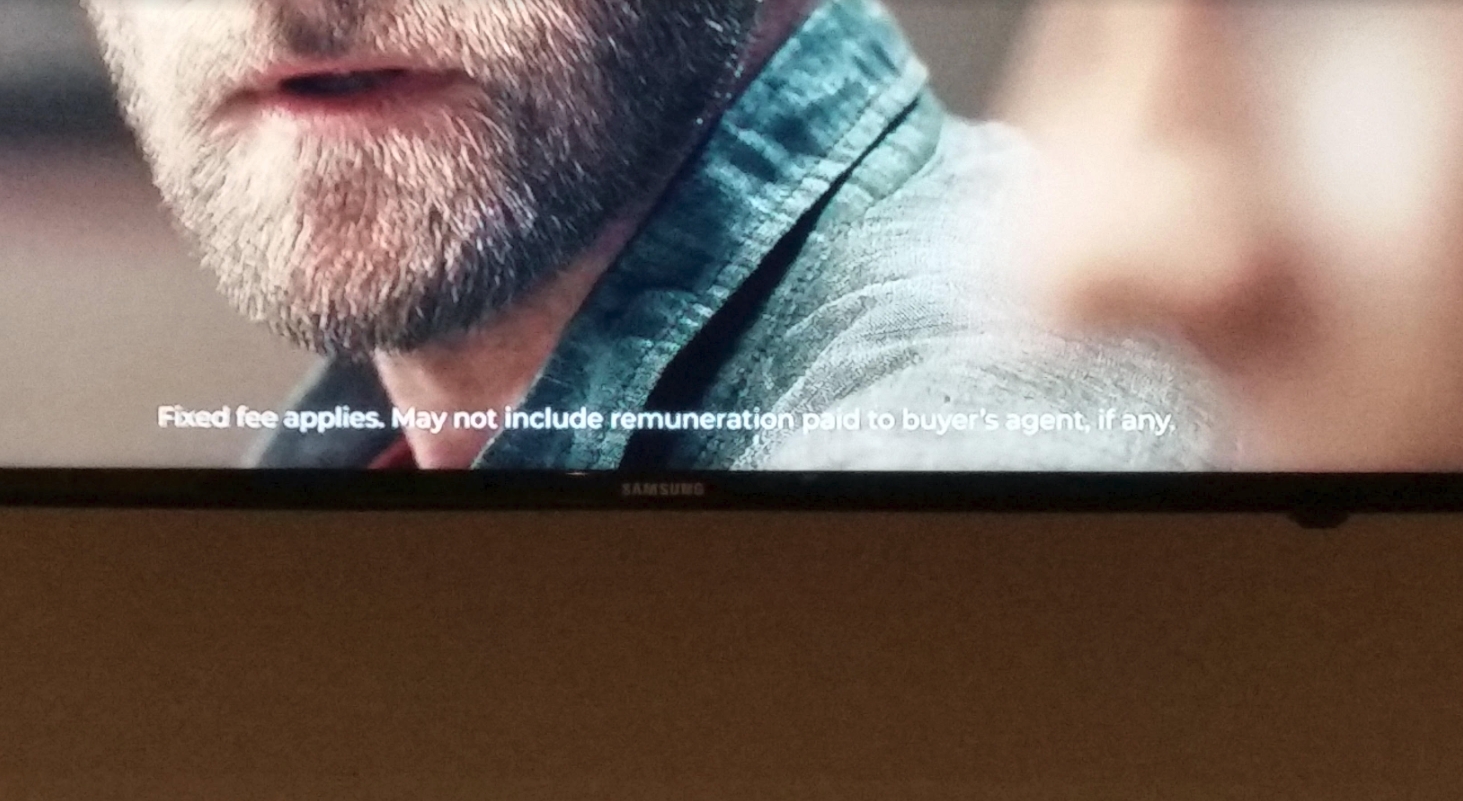

Something that bothers me about the Purplebricks television ads is that they make it sound like you don't pay commission. Like, zero commission. That's why you've always got to pay attention to the small print. Here's me taking a picture of the ad's fine print.

If you can't make it out (depending on what device you're reading this on), it says "Fixed fee applies. May not include remuneration paid to buyer's agent, if any." I love how they avoid the apparently dirty word, commission, and instead use remuneration. Purplebricks has sold a total of 4 condos in the 416. Every single one of them has the following posted in the Brokerage Remarks at the bottom of the MLS listing (this is the section that the pubilc can't see, and usually has some administrative details (and where offer dates are also hidden):

I Coop Commission Paid By Seller Through Seller's Lawyer At 2.5%. Use Form 202.

So yeah, "if any." When a buyer working with a realtor, sign a Buyer Representation Agreement there's a spot where the realtor's commission remuneration is spelled out. (You can see it in section #2 at the top of page 2 here.) In the Toronto marketplace, the going rate is 2.5% of the purchase price. It's never usually an issue with buyers as it's paid by the sellers in the vast majority of cases. Most listing agents always make sure the buyer rep gets 2.5%, so if they reduce the overall commission to 4.5% for the seller, they'll just take 2.0% while keeping the buyer (a.k.a. co-operating brokerage) commission at 2.5%.

Where this becomes an issue is if the seller (or listing rep) cheaps out on the commission. The way the clause is written is that the buyer will have to pay the difference so that their agent still gets 2.5% of the sales price. So if it's a $400K condo sale, the normal 2.5% would be $10K to the buyer's agent. Well say the seller is a penny-pinching FSBO person and doesn't want to pay a cent to the buyer's agent. I'm advising my buyer to offer $10K less ($390,244) so that her total out-of-pocket cost is still $400K. So, in my opinion, it's dumb for a seller to not offer to pay the co-operating brokerage commission because you're going to net out the same in the end when people pay you less for your place.

For what it's worth, I find the UK disclosure (I took a YouTube screengrab) interesting as it's much more explicit. I also like it that they show you owe this flat fee no matter what (here it's generally straight commission, so you pay nothing if the house doesn't sell).

How Purplebricks works internally

Something I found interesting about Purplebricks is their internal business model. This model seeems to be failing them. They announced last month (May 7) that they're exiting Australia. Also recently they've had a lot of turnover of top executives in the United States and they've scaled back operations and are currently reviewing what's ongoing there (they only launched in 2017). A couple of founders have cut their shareholdings, and the stock is in turmoil (a price chart was in the Globe article).

Their model is a low-cost, high-volume model (that has yet to achieve volumes). So what attracts agents tp them then? In a word: stability. The way most brokerages across the GTA work is that their agents are self-employed. They make a sale and the brokerage takes a cut of that. Timing of payments is sporadic. Agents don't get paid until a deal closes and all the money is transferred via lawyers and the keys are handed over. You could get paid three times in one month, then not get paid again for four months (it's a seasonal industry). Agents also often pay a monthly desk fee to the brokerage (mine is about $100 a month).

With Purplebricks, they offer agents a base salary. They get paid vacation, plus a benefits package. There are no desk fees, and they cover professional fees and dues (about $1500 a year). You're supposed to put in 40 hours a week for them, and you have to be available on 3 weeknights and 1 weekend day. So it helps some have more reliable schedules. The other interesting thing is that they break up the process. So if you were selling a house, one person is working on securing the listing from the seller. From my understanding from talking with an agent there, that's all they do. Then if somebody ponies up $1,500 for negotiation help, that's another agent. Want to work with that Purplebricks agent you liked to help buy your next place? That's another agent. So it's a bit of an assembly line.

Further to your salary, you're encouraged to up-sell the a la carte services like booking appointments, as you make bonuses for bringing in the extra revenue. A New Zealand real estate blog noted your main incentive is to get the listing itself for the flat fee. Beyond that, there's not much incentive as that's paid upfront. The blog points out "This arrangement was unlikely to attract and retain high-quality agents." The Globe article says, "a tier of top-earning agents is unlikely to move."

In their defense, I will point out that in my opinion, not all successful agents (dollars-wise) are great agents (performance-wise). I've seen some of those highly-advertised agents in action and basically they're a figurehead to do the pitch to win your listing. Then they pass it off to some underling and let whatever happens happen. I've seen very questionably-priced places just rot on the market and the famous agent doesn't seem to care. But you see their open house signs around and flyers in the mail so many people get the impression they must be good. There could be agents that know what they're doing but just not be good at bringing in business (buyer or seller clients). As the Royal LePage gentleman points out, Redfin seems to have a more sustainable model due to their focus on customer satisfaction, rather than Purplebricks' focus on just being the "cheapest alternative."

You get what you pay for

There's a part where it talks about me making the point that "If an experienced agent charges more commission but can't help sellers quickly generate a bidding war with strategic pricing and staging, he says he believes many people will decide it is not necessarily the more expensive option. "I think it's a bit of a get-what-you-pay-for thing," he said."

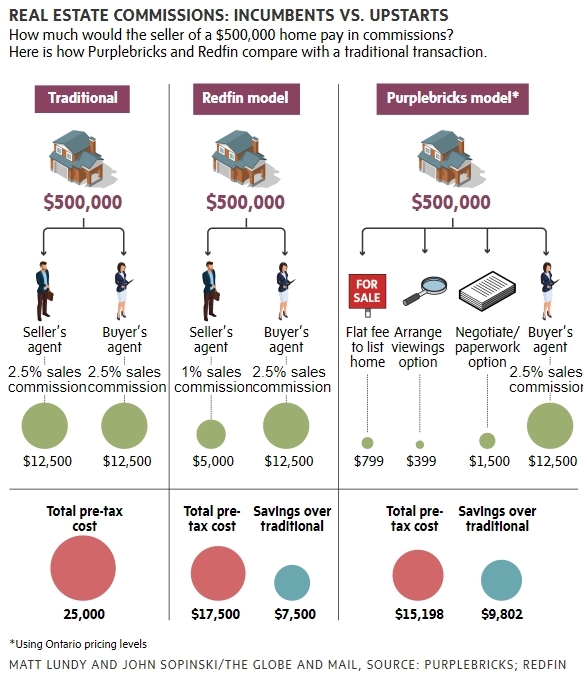

Here's a chart the Globe ran in the article. The helpful part is they are upfront in showing that you still have to pay the buyer rep's commission in either case.

As you see, it shows you can save $9,800 on a sale of a $500,000 property. But what if your realtor staged the property well and held offers and generated 6 offers and got you $515,000? You'd be better off on a net basis. A traditional realtor, since they're paid on commission, are incented to get the most money for your property. The Purplebricks people already have your money so once it's up, what's in it for them? I mean, hopefully, they're professional and see things through, but...

I looked at all unavailable (sold, terminated, suspended, or expired) freehold listings in the GTA that had a contract date between December 1, 2018, and May 30, 2018. There are 834 listings unavailable listings that had 100 days on market or more. Purplebricks has 10 of them. So that's a 12% share though we saw they only have about 1% of the listings. So a lot of them tend to linger.

When I looked at Purplebricks sales in the 3 months March to May of this year, there were 17 freehold transactions in the 416. Of those, 4 sold over asking (23.5%). In the broader market in that time, 40.5% of sales were for over asking. The average days on the market for the 17 sales was 28 days, while the 416 market average for freeholds was 17 in those months.

So their listing agents don't appear to be taking advantage of the "holding offers strategy" to maximize sold prices, and the properties are sitting for about 65% longer. That's what I had in mind when I was saying "get-what-you-pay-for."

Some other points in the article

There are a few other things I read in the article that I wanted to comment about. Here they are:

(i) Electronic signatures - talks about a Purplebricks client that "signed all the sales and purchase documents from his couch." I just wanted to note that everybody uses electronic signature service these days like DocuSign or Authentisign. It's certainly not unique to Purplebricks agents.

(ii) Commission rates - talk about (In Canada, standard home sales commissions often total 5 percent, split 2.5 percent each between the seller's and buyer's agents." This is the case in the Toronto market but varies across the country. I've spoken to agents in smaller communities outside of Toronto and 6% is more frequent (especially in cottage areas). In Vancouver, respected agent Steve Saretsky told me its "7% for the first $100,000 and 2.5% on the balance, split between both agents."

(iii) Redfin - mentions they opened a second Canadian office in Vancouver. I saw a story in Real Estate Magazine on this where it quoted the CEO as saying "We've been encouraged by a few early sales in Toronto." It made me laugh because it sounds like he's being modest, but as above it's only 4, so a few is very accurate :)

In summary

There's room in the market for more players, certainly. And if somebody doesn't see the value of an agent (both qualitative and quantitative), well that's on an agent to explain it to them. I could represent myself in court - hey I've watched shows on TV. Would I do it in traffic court where 3 points and $200 are at stake? Possibly, because stakes aren't that high (though actually I deferred to an experienced paralegal once when that came up). Would I represent myself in a murder case when a life sentence is at stake? Obviously an extreme example, but I think it suits my point.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment