With 2019 almost upon us, I thought I'd share my thoughts on what I think the Toronto real estate market will look like next year. I've already shared some thoughts in this BNN Bloomberg article, but obviously I can go deeper here. Just as I concluded in my "What's in store for 2018?" (which I think played out pretty accurately), the year starts out with more headwinds than tailwinds.

I'll use a similar format to last year, where I break down the headwinds and tailwind. In case "headwinds" is too jargon-y, a headwind is something that slows the momentum of something (e.g. an airplane). I've broken these down into known, likely, and potential.

Known Headwinds <<<

1) OSFI B-20 "Stress Test': This was a much bigger factor going into 2018 as it kicked in January 1, 2018. The Office of the Superintendent of Financial Institutions (OSFI) announced its Guideline B-20 a long time ago, so people knew it was coming well in advance. There was a revised draft on July 6, 2017, then it was made final on October 17, 2017, a couple of months before going into effect. The big item in here was the introduction of a "stress test" on uninsured mortgages (i.e. those where buyers put down 20% or more), where you now have to be able to qualify at a rate of 2% higher than the contract rate (or the Bank of Canada rate, whatever is higher). The government had already introduced a stress test for insured mortgages (less than 20% down) back in October 2016.

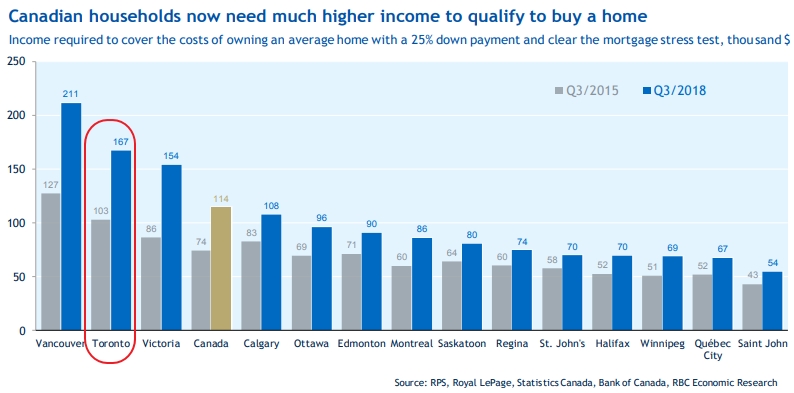

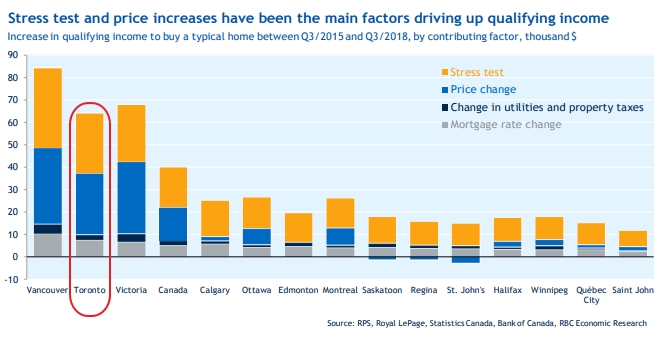

So it's had a year of run already, and people were given advance notice, so to my mind it should be pretty baked-in to prices already. But RateSpy mentioned that "borrowers will likely adapt within two to five year" so I'm leaving it in as a headwind for now. It won't be sending new shockwaves through the market, but you can tell it definitely had an effect. In Q3/2015 RBC calculated that to buy an average home in the "Toronto area" (I'll just say "Toronto" going forward), the income necessary to cover ownership costs was $103,000 (i.e. the amount to qualify to buy the home). For RBC's mot recent Housing Trends and Affordability report that number has climbed to $167,000 (see below for both figures).

Part of that $64,000 increase for Toronto was due to price increases over those 3 years - $27,000 per the report. Remember, 2016 was a huge year in terms of sales volume and price run-ups. But look below at the breakdown for the $64,000 and you'll see that the stress test has added just as much to the increase in qualifying income (also $27,000 on an $857,000 average home).

So the stress test isn't a new thing, but it's still knocked some people back that were about to get into the market, and it's squeezed the budgets of others that were trading up. So it obviously can't be helping prices. Going into 2018 TD Economics estimated that demand would decrease 5% to 10%, with a 2% to 4% drag on prices. Note, there have been calls from some corners (mostly real estate industry people) to reduce the stress test now that interest rates have risen. Bank of Canada governor Stephen Poloz has said the bank needs a year's worth of data before a worthwhile study can be done, so there is some chance this could be lifted.

►Effect: demand will be reduced because some won't qualify, and those that do will be able to borrow less money (though not everybody borrows right up against the maximum they're approved for).

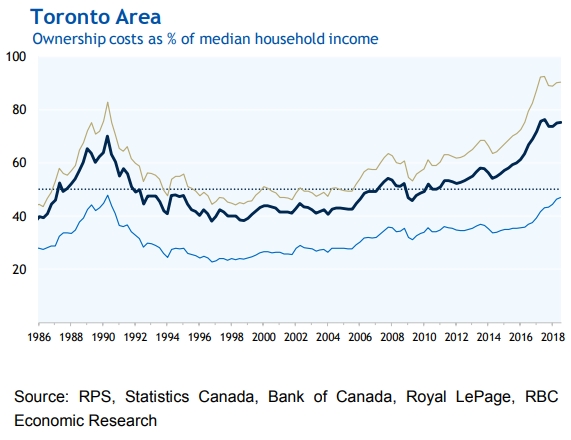

2) Affordability: This is shown somewhat above, but RBC's Housing Trends and Affordability report, show the aggregate affordability index (or unaffordability, because the higher it goes, the more unaffordable housing is) for the Toronto area is still sitting near all-time highs. Its aggregate measure of ownership costs as a percentage of median household income is currently sitting at 75.3% (the national average is 53.9%).

The good news is that last year at this time it was sitting at 78.4%, so it has improved by 3.1 percentage points. The single-family detached number is driving that aggregate decrease, sitting at 90.4% at Q3/2018 (based on $1,037,000 house price). That's come down from the Q3/2017 number of 93.8% (with $1,081,300 house price), which was an all-time high.

The bad news is that Toronto area condominium apartments have gone the other way as prices in that segment have risen in 2018. The Q3/2018 affordability index is at 47.0%, which is an increase from the 43.4% it was at Q3/2017. That puts it at or near the all-time high reached in 1990.

Compare the 90.4 for single-family detached to the average since 1985 of 58.4, and the 47.0 current condo apartment versus the 31.9 average and there is still an elevated amount of risk built into current prices. At least it's not as bad as Vancouver (117.3 for SFD and 42.4 for condos)!

►Effect: Last year I wrote "This could mean lessened demand for detached houses as they are out of reach of many would-be buyers. It also could mean increased demand in the condo market, as buyers train their eyes there instead." What played out was the condo sales demand dropped off less than houses (-11.1% versus -14.2% YTD November). And we saw condo prices increase, while houses fell. That feels about right for 2019, though I don't think condo prices will appreciate as much as they did this year (7% year-over-year as of November). Regarding the 2018 decrease in resale transactions (-15.8% for all of TREB at YTD November putting it on pace to be the lowest transaction year since 2008), RBC said "Don't hold your breath for a meaningful rebound in 2019."

Likely Headwinds <<

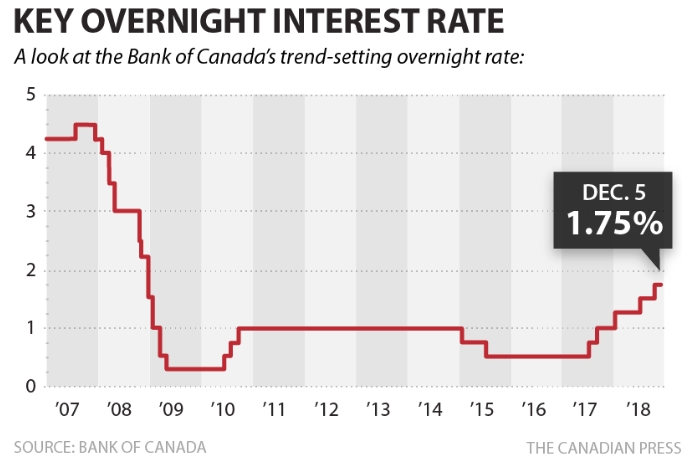

3) Higher Interest Rates: The Bank of Canada raised its overnight lending rate twice in 2017 - in July and September, each by 25 basis points (i.e. 0.25%). In 2018 there were three raises (January, July, and October) and it now sits at 1.75%. That's a fair amount of activity over the last two years, especially given that the July 2017 rate increase was the first increase in 7 years.

Source: Global News, December 5, 2018

The Bank of Canada noted less momentum heading into the final quarter of 2018, and it seems to be taking a "wait and see" approach to future rate hikes as it feels out other economic factors, including inflation which was 2.4% in October - a little higher than its 2.0% ideal. So many are expecting that rates will not increase until at least the April 2019 announcement. of 2019, when the hinted at further rate hikes in the new year. Rates were about as low as they could possibly go, so they seem a lot more likely to increase than decrease in 2018. RBC has stated it expects the Bank of Canada to hike its overnight rate two more times next year.

►Effect: As interest rates increase (they do not appear to be decreasing anytime soon), demand will be reduced as buyers will be able to afford less.

Potential Headwinds <

4) Tighter credit: I had this as a likely headwind last year, as 2017 saw Home Capital Group scandal get a lot of coverage, and Laurentian Bank said it uncovered some "problematic loans" due to "client misrepresentations". Some industry watchers had hinted this was just the tip of the iceberg. I figured lending institutions knew they were going to have more eyes upon them so they would tighten up their underwriting practices.

Something we did see happen in 2018 was that TD and RBC tightened their policies around HELOCs. Now in calculating debt service levels of mortgage applicants, those with HELOCs are assumed to have the whole amount as debt - even if they have a zero balance. Can the other major lenders be far behind?

►Effect: Tighter scrutiny will prevent some from qualifying, and some may have to resort to higher rate loans (therefore having less money to spend on housing). As RateSpy notes, "People with existing HELOCS will qualify for fewer/smaller mortgages, putting a small dent in sales of second homes, rental units and vacation properties." If the Bank of Mom & Dad has a harder time qualifying for their own financing, there will be less money available to gift/loan to their kids (and 4 in 10 first-time homebuyers are getting some down payment assistance from relatives).

5) Government regulations: There doesn't seem to be as much potential here as there was heading into 2018. There was major government intervention in 2017, with the largest effect on the GTA housing market being the Ontario Fair Housing Plan (OFHP) from April 2017. The new Progressive Conservative provincial government rolled back a piece of the OFHP legislation in November by ending rent control for newly built rental units, which they said would help supply of rental units. The provincial government, I would say, would be more likely to add tailwinds in the near-term, but something under its domain is REBBA 2002, the provincial legislation that governs real estate professionals. The Real Estate Council of Ontario (RECO) has tabled some proposed reforms to the current act. A lot of them would keep real estate agents more in check from doing shady stuff, and if any of these proposed changes were to affect prices, it would generally be in the direction of cooling them (e.g. "Curbing Sale Price Underquoting"). Another provincial possibility, though I hear no talk about it here, is a ban on "shadow flipping" as BC has done.

The City of Toronto got involved in 2017 by passing regulations for Airbnb and other short-term rental sites. But in September of 2018 they delayed the implementation for at least a year. Oh, Toronto. *shake my head* The rules were to help ease pressures in the tight rental market, by making it harder for owners to do short term rentals (thus turning those units into rental supply for residents). If the rules ever do come in, rental revenues for some properties will decrease, so people won't pay as much for them. Potential future measures include a vacancy tax (like Vancouver's Empty Home Tax), though this hasn't picked up much steam here.

The federal government has become involved too, via the Canada Revenue Agency (CRA). In 2017 they finally started looking into money they were being cheated out of from a lack of record keeping around flipping of pre-construction condos. Going after real estate transactions has been an area of increased focus in recent years, and I expect that will continue. The CRA did "send a message" this year that they're going to get tougher by freezing assets and seizing property of tax evaders. If people know real estate transactions are being watched more carefully and there's more likelihood profits will be reduced after taxes, an investor won't pay as much for a property.

►Effect: Most of these would lower demand if implemented. The Ontario PC move was very in-the-face of a movement toward more regulation and scrutiny with the real estate market.

6) Market Psychology: For 2018 I think this was a bigger factor, as I thought people would be bummed reading all the news about how prices and volumes were down versus 2017. But I think people got used to it pretty fast and prices pretty much stabilized for houses, and even have increased for condos. In 2019 I don't see any risk of FOMO craziness (a tailwind) like there was in 2016 - especially coming off a year with the lowest number of GTA resale transactions since 2008. If there's any risk this year, I think it's that the economy starts going south and takes the real estate market with it (though it's a bit of a chicken-egg thing at this point). You can add the stock market to that too - as we saw a really rocky close to 2018. If people are losing a lot of money on stocks, they aren't rushing out to buy more real estate.

►Effect: Demand could be lessened, and prices may fall if people are forced to sell due to poor personal financial situations (it's hard to carry a rental property with a $1,000 negative monthly cash flow (35% of 2017 condo investors) when you lose your job).

>> Potential Tailwinds

So there's a lot that is going or may go against the Toronto real estate market. Is there anything that supports price increases? Well, yes there is.

1) Land constraints: They're still not making any more land here :) So supply will always be constrained. This affects houses more than condos as they're still squeezing in thousands of more condos as the city densifies.

2) Immigration: This is made up of two primary factors - New Canadians and inter-provincial migrants. Canada has increased its immigration targets for the next few years, from 300,000 in 2017 and 310,000 in 2018 to the following:

2019: 330,000

2020: 340,000

2021: 450,000 (recommended by the federal government's Advisory Council on Economic Growth)

Those can change if a new federal government is brought in, but the next election isn't until October 2019 so it won't have an effect on this year.

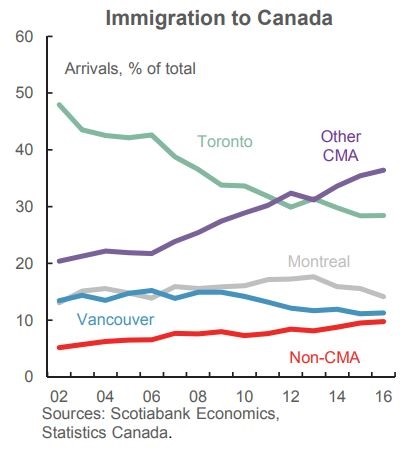

Interestingly, the share that settle in the Toronto CMA has been declining (green line):

Source: Scotiabank Global Real Estate Trends report, December 15, 2017

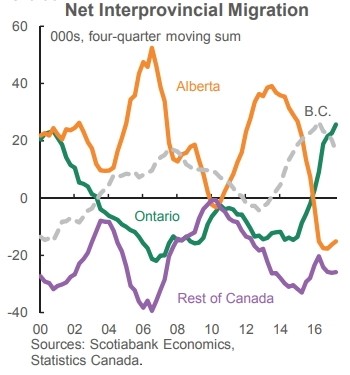

Still, even it dropped right down to 20%, that's still over 60,000 new people in the Toronto CMA every year from Immigration alone (and if it's closer to 30% that means 90,000 people). The second factor, inter-provincial migration, had Ontario looking popular in recent years (dark green line below). But this factor is more volatile , due to economic factors (e.g. if oil in Alberta is booming or not). This influx of people should help keep the demand fires burning. Here are the Ontario government's official projections in the next few years, with the GTA "projected to be the fastest growing region of the province."

Source: Scotiabank Global Real Estate Trends report, December 15, 2017

Note that these "Toronto" above is the Toronto Census Metropolitan Area (CMA). On the City's website, the 2017 numbers were 2.930 million for the City and 6.346 million for the CMA, so the 416 represents about 46% of the region's population currently (which can and will differ from the percentage distribution of new residents).

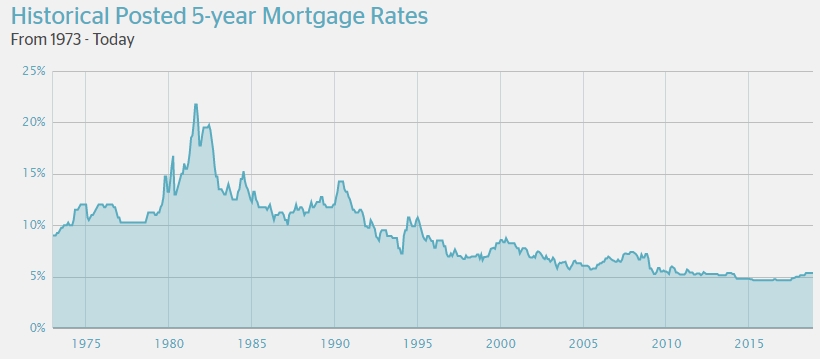

3) Low interest rates: While rates climbed a little last year, and may climb some more this year, they're still very low historically (as you see below), and that helps affordability, which helps demand.

Source: RateHub.ca 5 Year Mortgage Rate History

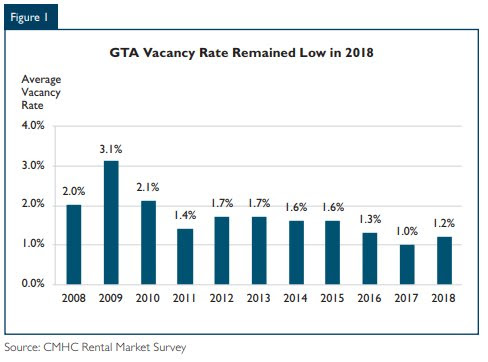

4) Tight rental market: Continued low vacancy rates, and increasing market rent prices would make buying investment properties (mostly condos) more attractive. Though the OHFP did put some rent controls in place for condos, which would make buying for investment purposes a little less attractive (though as also noted above, Doug Ford's government relaxed rent controls on new units going forward). This affects condos much more than houses.

I think it's safe to say the majority of immigrants don't jump right into the housing market, but rather rent first - especially non-permanent residents. Interprovincial migration and non-permanent residents can turn around pretty quickly if the economy sours, as you can see in the jump in vacancy rate from 2008 to 2009 above. So things can change but it's got tailwind status for now. One other reason this is a tailwind is that if rent prices keep rising, buying becomes a more attractive option.

5) Foreign buyers: With the so-called "foreign buyers tax" already in effect for the Greater Golden Horseshoe (GGH), there doesn't seem like change in headwinds or tailwinds.The lessened foreign demand in the immediate aftermath of the OFHP is already baked in now. The biggest change I could see affecting foreign buyers from 2018 to 2019 would be the change in the Canadian dollar. If our dollar tanks, suddenly prices look a lot better to foreigners. And several forecasts show the Canadian dollar will get worst against the USD in 2019 (though forecasts are just guesses, and BMO Capital Markets has it going the other way.)

►Effects: Increased demand.

In Summary

While I think the year will start out slowly for the Toronto real estate market, it may look favourable in terms of transactions in the first couple of months because Jan and Feb 2018 may have been artificially low due to many transactions being pulled forward into Nov and Dec 2017 to beat the stress test. As in 2018 there are a lot more headwinds than tailwinds - and I see the tailwinds as singles and maybe doubles, but the headwinds could have some doubles or even home runs in there.

As I said last year, the big X-Factor on top of all the above is the economy (local and national). Everything above is based on the status quo (i.e. moderate GDP growth as we've seen from 2010 through this year). If it ever goes south, then I think we'll see a pretty sizable correction - especially given the heightened affordability (or unaffordability) situation in this market currently.

*NOTE* I am not at all saying don't buy real estate in Toronto right now. This market has a lot going for it, and if you're buying for the long term I believe everything will work out fine. If you see a house today that you really like in an area that you like and it's within your budget, go ahead and buy it and enjoy it. I do think speculators (with their shortened timeframes) and investors (especially newer ones with tougher cashflow situations) are in a lot riskier place right now.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment