Here we are with Part 3 of this three part series with me complaining about stuff I don't like about real estate currently. You can find Part 1 here and Part 2 here. On the last two points, one is a provincial matter, and the other one is a much broader issue but I'll focus on some possible Ontario and Toronto solutions.

7) Home Inspection certification

As Bob Aaron, long time real estate law columnist in the Toronto Star put it,

In Ontario, anyone with a business card and a flashlight can be a home inspector. There is no requirement for training, competence, insurance or regulation. The current situation ultimately hurts consumer confidence and the home inspection industry as a whole.

So when consumers (home buyers) are relying on the information and insight from the inspector when contemplating making likely the most expensive purchase in their lives ($1.4 million average 416 freehold price, October 2020), that’s not a good thing.

There are a couple of organizations that inspectors can join, like the Ontario Association of Home Inspectors (OAHI, who bill themselves as “the oldest and most respected Home Inspection Association in Ontario”). They are a self-regulation body created by the Ontario Government in 1994. They have the “exclusive right to define qualification requirements, regulate its members and grant the designation "Registered Home Inspector" and "RHI" to qualified practitioners in the Province of Ontario.” Members need to comply with the OAHI Standards of Practice, and a Code of Conduct, and maintain professional liability insurance.

There’s also the Canadian Association of Home and Property Inspectors. When I’m doing due diligence for my buyer clients, and a house they’re interested in offering on has a pre-listing home inspection that my clients are relying on, I always look up the inspector to see if they’re a member of one of these organizations. It is possible somebody could be a member and still be a crappy inspector because they’re lazy, and you could have a very knowledgeable and diligent inspector that’s not a member. But on the whole, I think a report from a someone that cared to join one of these organizations (and has pledged to meet and maintain professional standards) gives more assurance than one from someone who doesn’t. And that means less risk in relying on the report. For buyers risk reduction is a good thing.

So what’s being done about it? Well, as you’d guess in our bureaucratic country, in December 2013 the Ontario government commissioned a "blue-ribbon panel" to report on industry regulation. That report recommended setting up a governing body to license, govern, and regulate inspectors.

Then a couple of years passed and the panel reconvened in 2015 to affirm 35 recommendations from the earlier report. Then a Bill 59, the Putting Consumers First Act was introduced in November 2016. Then in April 2017 the Home Inspection Act finally passed and received Royal Assent. And now 3 and a half years later and it still hasn’t come into effect, and won’t until “the government has drafts and proclaims regulations to oversee the profession.”

B.C. has licensing and anyone can go on a provincial website to verify if an individual licensee is legit. Alberta inspectors must have a license and carry it with them. They have a similar provincial website where you can verify home inspection companies and individual inspectors. Ontario? Still working on it. Slowwwwwwly. And that sucks for consumers.

8) Discourage the financialization of housing

Maybe this section is broader than the section header. This all comes down to people (and people through corporations) treating residential properties as an asset class. And this has been hurting housing affordability for years, bringing it to either a crisis stituation or bordering on one. I'm aslo concerned here with the growing wealth disparity in our society. I see this all the time with so many first time homebuyers getting gifted funds from their parents to help get into the market. If the only people that can afford to get into the housing market now are children of parents who already own a home (and have the equity to pull out) we're in a rich-get-richer and haves versus have-nots type of environment. I can't fix all of that, but I think the following measures would be helping a little bit on affordability by discouraging over consumption of housing by the comparatively wealthy. That lessening of demand should help prices.

i) Introduce vacant home tax

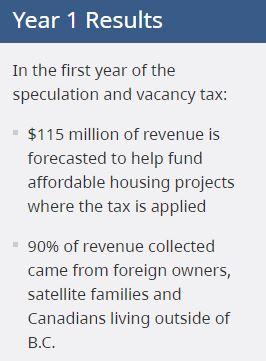

This one is pretty easy to comprehend, and I'd like it to be for the City of Toronto, but maybe it's even a provincial-wide thing because I recall several tales of empty houses in York Region back in 2017. The purpose would be to keep housing for people that live in the city and use it. Not to park your money and sit on it as an asset. So if the house is sitting empty then you have to pay a fee annually. British Columbia has a Speculation and Vacancy Tax which “is designed to turn empty homes into housing for British Columbians, and ensure foreign owners and those with primarily foreign income contribute fairly to B.C.’s tax system.” If it’s your principal residence you’re exempt, so it’s less than 1% of properties that it applies to. It looks to have been successful so far.

The City of Vancouver enacted their Empty Homes Tax in 2019. The rate was 1% of the property’s 2019 assessed taxable value (they do assessments every year in B.C., as opposed to every 4 years in Ontario). For 2020 they have raised it to 1.25%. Property owners have to submit a declaration, and if they don’t submit they are deemed to have an empty home. I like that net revenues from the program are reinvested into affordable housing initiatives in the city. [Update - shortly after I posted this blog, Vancouver raised the tax again, this time to 3%. It was noted that the tax had raised over $61 million for affordable housing and had reduced the number of vacant properties by 25%.]

I’d model it fairly closely to Vancouver’s program. If you want more details you can check out their FAQs. I’m not sure what an appropriate rate would be in Toronto. We have such low property tax rates (the combined city and education tax rates plus the city building fund came to 0.599704 for 2020), so Vancouver’s 1.25% rate would be double regular property tax rates here.

ii) Introduce property surtax for secondary homes

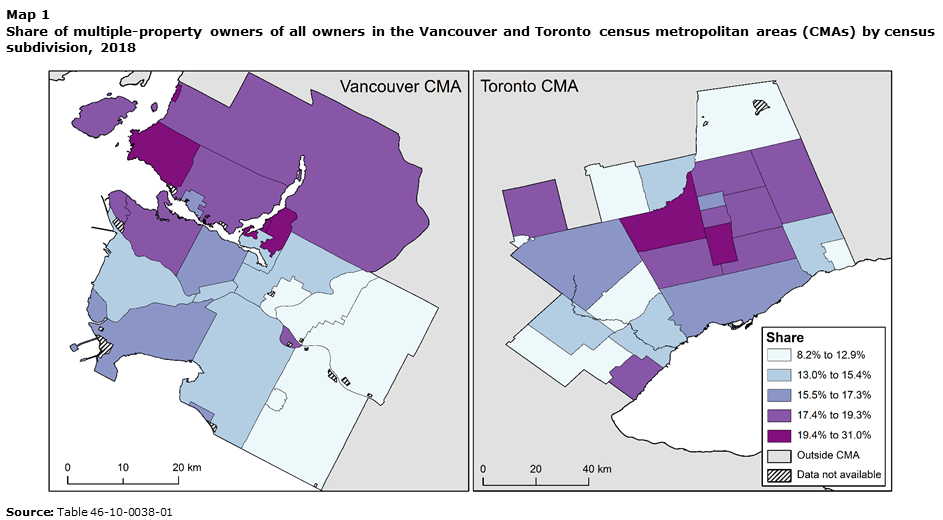

For this one I’m trying to disincentivize investors that own several properties. The more they’re hoarding properties, the less supply there is for end-users to purchase, which makes the market tighter, leading to higher prices. A Statistics Canada report from 2018 showed 359,475 multiple-property owners living in the Toronto CMA.1 And in the City of Toronto the proportion of all property owners than owned more than one property was 16.4% (highest concentrations in the CMA were King 25.4% and Richmond Hill 21.0%). That’s pictured below.

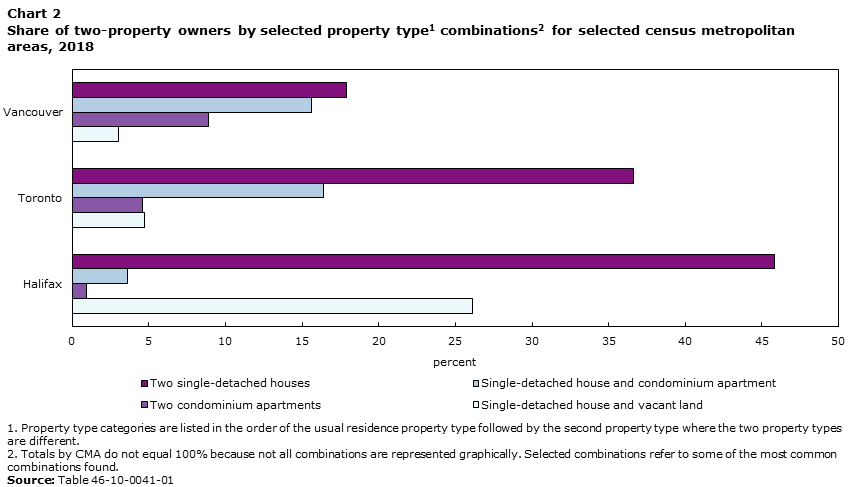

In Ontario, 76.0% of owners with multiple properties owned exactly 2 properties, 16% owning 3 properties and 8% owning 4 or more. For the two-property owners, you can see the split below. Keep in mind this is for the CMA, so the fact that two single-detached is the most prevalent combo could be somebody that lives in King City and owns a second property in Markham. I’m not sure what the split is for just the City of Toronto (416), but I’d bet condo combinations are a lot more prevalent.

Now to be clear, I’m not talking going after somebody that lives in Toronto and has a cottage in Muskoka. I’m talking about somebody that has a house in the Annex and two more condos in Entertainment District. Or a house in Markham and a condo in Scarborough. According to the study, 46.8% of the multiple-property owners owned all of their properties within the Toronto census subdivision (CSD). So more than half don’t.

What I’m proposing is if somebody owns a second property, they declare which one is their principal residence, and the other ones they pay double the property tax. They have a levy on second homes in Paris like this.

I don’t have all the answers worked out here. I haven't modeled any numbers or anything. Maybe this amount is too low to discourage - the average property taxes on a 500-599 sqft condo sold in April was $1,928, or $161 a month. The average price of those condos was $550,502 so the property would only have to appreciate 0.35% a year to cover that (and it's an expense for income tax purposes so that lessens the blow). Is that too little of an incentive? Maybe it should be triple or quadruple (since Toronto’s property tax rates are low to begin with). Or maybe, to be more radical, your property taxes would double on all of your properties (i.e. the home you live in and the investment property). The average sales price of a 416 freehold in April was $1,186K; if I take a plus/minus $50K on that, the average property tax for those properties was $4,977 ($415 a month). That $5K a year is certainly more of a discouragement. And if your house is worth a lot more than average, it's an even bigger disincentive for stockpiling housing. Currently we have a system set up for letting the rich get richer while putting home prices further away from the average person. Maybe this would help the imbalance.

What if somebody owned a place in the City of Toronto and then buys an investment property in Hamilton (I know more than one person in this situation)? Maybe the Ontario government should make it the Greater Golden Horseshoe Region. Or make it province-wide because that same person could just shift their money to Kitchener or London or Windsor. Or make it you (or your spouse) were allowed to own two places in the province and then are heavily taxed if you own three or more. Or are simply not permitted to own more than two.

I traced one condo owner the other day through the land registry office and found out they owned 8 condos in the City of Toronto. Do we need that? I've heard the argument from the developer side that we need these investors to buy the places so that the buildings can be built. But what if "investors" didn't buy those pre-construction condos? Well, a lot of downtown condos are 50% owned by investors so this would be a big change. So what would happen if we took out a lot of investors (that didn't want to pay increased property taxes or whatever rule discourages them from buying)? Well the condos would take longer to sell and therefore build. And that would squeeze supply (or supply wouldn't ramp up as quickly). But also if they're not selling then the prices would have to drop. I could see resale becoming more affordable, but rents increasing (due to less investors renting out). But at some point if rents are getting close to the costs of carrying a condo you purchased, then people will be incented to buy.

iii) Ban corporations from owning residential property

One workaround for the last piece would be if somebody just created a corporation to purchase the homes. Let's just nip that in the bud. I would ban corporations from owning residential real estate. I'm operating under the premise that housing should be for the people here. I've got freehold and condominium properties in mind here, not purpose-built rental apartment buildings. So who would be affected by this?

Large developers - I can see how large condo developesr like a Tridel would need an exemption as they often have unsold condo units to sell once construction completes. [June 2021 edit - it recently came out that a Toronto-based developer called Core Development Group plans to purchase $1 billion of single family homes in Ontario, Quebec, Atlantic Canada and BC by 2026. The company's goal is to convert them to two-dwelling homes by adding basement apartments, and then renting them out. So far in 2021, according to the Globe & Mail, they've spent about $50 million on 75 Ontario properties. I can't imagine competing in a bidding war with a large corporation. It's not removing housing. In fact, it's creating more units by adding the basement suites. But it's forcibly removing owner-stock and converting it to rental stock. And I'm against this large scale manipulation. It's a tiny percentage of our housing stock, but what if pension funds and hedge funds jump on this bandwagon? Again, keep our houses owned by the people, for the people.]

Small developers - I see properties listed all the time on TRREB's MLS that are numbered companies or stuff like "CF Devco (Ontario) Inc." I can see in a free market how they're servicing a need. Some people might want to live in an area but don't want to live through a renovation. This new rule would hurt these companies. But it doesn't prevent them from pivoting to becoming contractors that people hire to renovate their properties.

Flippers - This is a similar boat as above. I see flippers owning places through corporations all the time. Do we need flippers? You want to talk about affordability, flippers are certainly driving up prices by competing for houses with would-be end users. And then they turn an $800K house into a $1.2 million house and the neighbourhood becomes more expensive and it's out of reach for that many more people. Well, these people would still be permitted to buy the house, but it would just have to be in their personal name and not a corporation. So that would be the municipality's gain (if they have to pay higher property taxes for owning multiple properties) and the CRA's gain (for less taxes sheltered within corporations).

Non-Real Estate Corporations - I know some companies also own a corporate suite or two, if they have frequent out of town visitors from other offices. In my corporate life I stayed in a townhouse near Orlando to complete some work. If those companies have to now pay for hotel rooms or Airbnbs to put up their employees is that a real shame? Not really, in my opinion.

Social agencies - I would also have exemptions for things like women's shelters, Toronto Community Housing, and the like where they own houses in residential neighbourhoods that are basically rooming houses for social good. In my mind I'm thinking lowrise housing, but I suppose an organization like the PanAm Games which held a lot of condo stock for athletes for the 2015 games should be exempt as well.

I see these "asset class" investors as a little bit like ticket scalpers. The scalpers jump in where they see demand for something that has limited supply and they know is popular. Then they scoop up inventory for themselves without any intention to see the event, all in the hope of making a buck off of people. I know that's the free market economy right there, but look what's happened when we've allowed all these extra housing "players" to go unchecked.

I think with this section, some grandfathering could be considered - though on the other hand these people/companies have benefited greatly already. But perhaps there should at least be a transition period. This way every corporation that owns residential properties isn't forced to dump them onto the market all at once.

The wrap-up

With all of the "8 things" in this series, details would have to be ironed out. But the important part is changing rules so that they are in the spirit of making things more transparent, and more fair for consumers, while taking some of the heat off the market. That heat currently benefits owners/sellers - and the real estate agents (57,000 TRREB members, 79,000 in Ontario) that benefit from higher prices.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment