I've been siting on this blog idea for a long time. I wrote a bunch of it during the initial COVID-19 slowdown in activity, but then things ramped way up and I never got to finishing it. The idea for this post comes from seeing several things in my time as a realtor that are either frustrating or seem like they could be improved - or both. The ideas vary in importance and potential impact, but since I'm The King I'm going to share whichever ones I please and in whatever order! And really there are more than 8 items, but I've grouped them into 8 buckets, which I'll talk about in a 3 part series. Here we go with the first part... (and here are Part 2 and Part 3)

1) RECO

What is RECO? The Real Estate Council of Ontario (RECO) "enforces the rules that real estate salespeople, brokers, and brokerages must follow. We protect the public interest through a fair, safe and informed marketplace." As Biggie said, "And if you don't know, now you know."

i) Tell me how long the agent has been registered

One of the things you can do on their website is look up someone purporting to be an agent, to see if they're legit. This is what you'd see if you looked me up:

So now y'all know my middle name. When a salesperson (official term for "agent" and RECO also uses the term "registrant") registers it is for a period of two years. So I recently renewed. So you get to see if the person is current or expired or even exists. But what it doesn't show you, and I think people should know, is how long a person has been registered for. Did they start in 1987, or did they start 2 weeks ago. Pretty relevant, if you ask me - especially if someone is fronting like they've been doing it longer than they have. RECO must have this info on file, so why not share this with the public?

ii) Discipline History should stay up forever

On the same page as the registrant info, there's a section to show if a salesperson has a shady past. Here's an example of somebody with a recent decision against them.

To RECO's credit you can click on that document and it goes through the case with the facts and the decision. (In this case the registrant took some keys out of a drawer during a purchaser visit, said she didn't have them when the seller asked, claimed to find them in her coat pocket several days later, then handed them over to her clients (the buyers) before the closing date and the buyers went and visited the property on their own before closing. She was fined $7,500.)

My problem with this is that they only keep infractions up for 5 years. So if an agent did some majorly shady thing 6 years ago or 12 years ago, the public doesn't get to know about it. Maybe they've done the same thing since but didn't get caught, or nobody reported it. I think discipline decisions should stay up forever. The public can read the documents and make their own decisions on whether what the agent did 8 years ago bothers them enough that they don't want them representing them.

Pro tip: If you are really into due diligence, you can email the registration office directly to inquire into an agent's full past at registration@reco.on.ca.

iii) Get tougher on sentencing

I've read some of these "Discipline Decision" documents. There are ones I've read where I've seen the fine the agent gets and have thought "How is this person even still allowed to be a real estate agent?" Here's one person I came across:

Yes, those are 5 decisions against them in just the last two and a half years. The fines on these were $4,000, $6,000, $10,000, $10,000, and finally $22,500. The last decision finally required the agent to take an ethics course and also one on legal issues. Two awesome asides here:

1) Her husband was also implicated and fined on the first offence (but it's his only one in the last 5 years)

2) Her website says (with a straight face), "I am a trusted and well trained professional."

So at least the fines escalated, but really there's no 5 strikes you're out? Let alone 3. There are over 56,000 TRREB members currently. If this person was forced to leave the profession I don't think the public will be lacking choice of other agents to use. That last decision with the $22,500 fine was for some questionable activities (agreed to have violated 4 different parts of the Code of Ethics) relating to double-ending a deal. The property sold for just over $1.3 million so the agent stood to gross nearly $66K on this at 5%. But if you do both sides it's common to give a commission reduction to the seller. So say they reduced their commission to 4%; that would mean $52K revenue. Even with a $22.5K fine, they walk away with nearly $30K so the shady double-ending still was worth it. Especially if they've done this a few times an have only been reported once. So how is that punitive? To me an agent should not be allowed to profit from any deal for which they did something major. Otherwise, the fine is just a "cost of doing business." Obviously the fines haven't been large enough to change this agent's behaviour to this point.

iv) Make decisions faster

The $22,500 decision above was issued on November 6, 2019. The sale of the property took place December 20, 2015, nearly 4 years earlier. Four years! How many shady deals had the agent done in the intervening time?

v) Make it easier to report a complaint

Have you ever tried to file a complaint through RECO? Oh my god. I remember starting a thread to tweet out all of the steps I had to go to on something and gave up about 12 steps into it because it was taking too long. It's almost as if RECO is discouraging you from making complaints. And they're supposed to be there to protect the interests of the public, so that's not how it should be.

One example for myself was there's an agent that put up a "coming soon" sign on a property across the street from me over a year ago. Honestly - I took a picture May 22, 2019 and at that point it had already been up 4-6 weeks. Still there as of time of writing this (UPDATE - it finally got taken down about 12 or 13 months after I first noticed it). After several months I got sick of seeing it, because it sure as hell wasn't "Coming soon to TREB's MLS system" as the sign rider stated. I sent in my complaint with a photo. Seems like a simple thing, they call the agent and boom - done, right? They finally got back to me and said a sign complaint can only be submitted by a brokerage. So I never did bother to drag my broker of record into it for the extra bureaucracy. Just ridiculous.

Another example is checking the number of offers a property has. The listing brokerage has to keep records of each offer received (or at least a summary of the offer, submitted by the buyer's agent on something called a Form 801), so if you're being told there were 6 offers you can verify that with RECO after the fact and the listing brokerage has to prove it. In a couple of cases where I was informed my clients were one of two parties offering, and we were the successful bidders, I checked in with RECO to make sure the second offer was on the up-and-up. Because obviously that would have changed our bidding strategy/amount if we didn't have competition so I wanted to ensure we weren't bidding against ourselves. RECO required me to send in the whole agreement of purchase and sale (which is part of a bundle of offer documents that are commonly in 12-15 pages range). Why can't I just send them the MLS number to look up? Why would I be sending in the request if I wasn't in on the offer? And they will get a copy of my offer documents or my Form 801 anyway, so they can easily verify I was a legitimate bidder before getting back to me. It's just useless bureaucracy at it's finest.

2) Land Transfer Taxes

i) Get rid of the provincial Land Transfer Tax

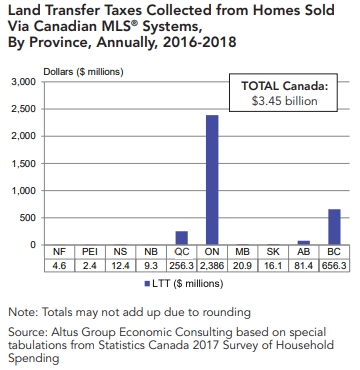

This one I don't expect to actually happen because it has been around for so long and the government has become so reliant on the revenue:

The provincial LTT was brought into effect in April 1974. It's a strange tiered system of rates:

$0 - 55,000: 0.5%

$55,001 - $250,000: 1.0%

$250,001 - $400,000: 1.5%

$400,001 - $2,000,000: 2.0%

$2,000,001 and up: 2.5%

Using a land transfer tax calculator you can see how much those brackets add up. I have two problems with this tax. First, several studies show how it harms the market, as this article points out:

Transfer taxes therefore cause people to hang onto their property for long periods, making it harder for new homebuyers to enter the market. These taxes also increase the cost to assemble land and materials to build homes, thereby reducing the supply of property. Even labour mobility is affected as it becomes too expensive to move.

The second problem I have is that the brackets above were unchanged for nearly 30 years from 1989 until 2017 when they introduced the 2.5% tier. When they were set in 1989 the average GTA sale price was $274K. That would mean the average property would fall into the third lowest bracket and only a property would have to sell for 46% above the average to have the top (at the time) 2.0% rate start to apply. In 2017 the average GTA sale price (all home types) was nearly $823K meaning more than half of your purchase price was in the top rate (before they brought in the 2.5% rate). With federal income taxes this is referred to as "bracket creep," that is the average price goes up and the brackets stay the same so a higher share gets taxed at the higher rates. In October 2020 the median detached home price in the City of Toronto was $1,165K and even the average condo apartment was well over the $400K threshold at $585K.

ii) Get rid of the Municipal Land Transfer Tax

Toronto's MLTT came into effect in in February 2008. Like the province, the City has quickly become pretty reliant on it. The City's 2020 operating budget is relying on an expected $800 million in MLTT revenues. (Spacing Magazine makes a case for reforming the MLTT and having the revenue applied to the capital budget instead.) As recently as 2018 the City had an $84.5 million shortfall on the $818 million it forecasted due. That's risky business. I know this sounds like "real estate agent bias" but I think if you follow me you'll know if I'm an industry shill or not. For more on this, here's a 4 page paper by Ryerson's Centre for Urban Research and Land Development laying out arguments for repealing (and shifting the burden to property taxes).

Obviously these governments would have a lot of revenue to replace ($0.8 billion for the City, more for the province since Toronto is but one municipality within Ontario), but look at the fees in Toronto on that $1165K median detached house ($39.5K) and $585K median condo apartment ($16.4K). When "affordability" is such a big issue, that condo $16.4K is nearly half (49%) of the $33.5K minimum downpayment someone would half to scrape up to purchase. (Though if they're a first-time buyer the provincial and municipal rebates add up to $8.5K). The governments are talking out of both sides of their mouths here. You can't charge this tax which puts home ownership further out of reach and then also talk about how you really care about affordability.

At least readjust the brackets relative to today's average prices to go back to the original intent where only high-priced homes get into the upper brackets. As of the end of October 2020 97.8% of GTA transactions this year were up into the (until recently) highest bracket of over $400,000. And then index the brackets to average home prices as they change over time.

3) Pre-construction housing sales

i) Cancellation protection - In 2019, according to this Globe & Mail article, there were 7 condo project cancellations in the GTA in 2019, representing more than 2,100 units. According to Urbanation there were 4,672 units cancelled in 2018, and 1,678 in 2017. In 2020 I'm aware of 278 cancelled units at East Junction Condos (plus more than 1,800 units at three Cresford Group condos have been placed under receivership). It really harms those buyers, especially in times of rising prices. Say a buyer places down their deposit with the intention of moving into the project when it is completed. They buy a $600K condo, say. If the project is cancelled two years later they get back the deposit, and maybe a tiny bit of interest. And now they have to go and find another place to live. But the problem is it might cost them $700K to go out an buy an equivalent (a 17% rise over two years was not out of the ordinary in recent years). Basically the would-be-owners are $100K behind where they would've been if the project hadn't been cancelled or if they bought elsewhere. That's significant.

Here's an excerpt from another Globe & Mail article, this one from November 2017 talking about the cancellation of Museum Flats, a 168 unit development in the Junction Triangle.

The developer said it was unable to obtain construction financing and cited "lengthy delays" in obtaining approvals and permits from the city. "The project is not financeable," said Alfredo Romano, president of Castlepoint Numa. "We cannot finance a phase of a project where you neither have the approvals in hand nor a budget that will support it. The passage of time has killed it."

My problem is that developers are allowed to sell units before obtaining final approvals. Above you've got one of the developers crying how long it has taken to get the permits and so they can't get financing because costs have risen. So if you want to have more cost (and revenue) certainty, why don't you wait until building approvals are obtained before you set your prices and sell units?

Another problem that occurs is developers will propose (and sell) taller buildings than end up getting approved. For example, Wellington House near Front and Spadina. It was originally sold as 24 storeys. Then as 19 storeys with 115 units. Then they tried for 17 storeys. People were sold units that were never going to exist, and their money was tied up in that.

I'm not quite sure how the overall timing will work on this because I'm saying you have to begin the sales process after approvals. I've read that lenders usually require 70% or 75% of the building's revenue to be sold before financing will be approved. So this could present new timing problems. Right now it's sell while you're waiting for approvals, get approvals, get financing, then build. I'm proposing get approvals, make sales, get financing, then build. With sales not happening concurrently with waiting on planning approvals, it could slow the whole project timeline down. But at least costs and prices would be a bit more accurate because they won't be forecasted out as far. To me the consumer protection benefits outweigh that. It should lessen the risk for purchasers to get screwed due to non-completion.

ii) Extend cooling-off period to freeholds

Currently if you buy a pre-construction condominium in Ontario (whether in an apartment building or a condo townhouse), you are protected by a 10-day "cooling-off period" in which you can change your mind and back out for any reason. This consumer protection was put in place due to high pressure sales tactics at some condo sales centres. But sales offices for non-condominium ownership housing does not receive this protection. I don't understand this at all because the exact same pressure tactics could take place at sales centres for houses too, and buyers are subject to the same FOMO at grand openings. So I'd also allow consumers the no-questions-asked cooling-off period for freehold homes.

That's it for Part 1 of this series. Part 2 and Part 3 (there are a lot of things wrong!) have subsequently been posted.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment