There have been a lot of articles in the news lately about blind bidding wars and bidding wars in general. Heck, the Toronto Regional Real Estate Board even felt obliged to issue a statement to its members about it:

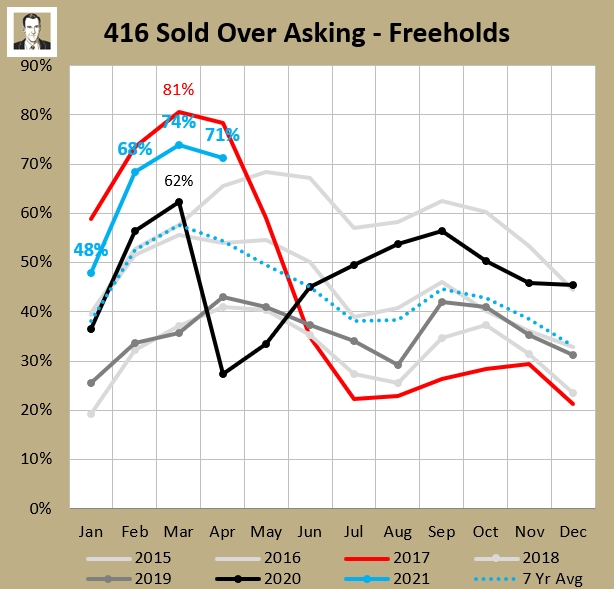

It's topical because through the first 4 months of this year, 69% of freehold (lowrise houses) sales were "sold over asking." So bidding wars are the standard this year (and these rates are even higher in the 905 currently).

One of the things that these articles sometimes decry is all the crazy buyers being "forced" to make their offers without conditions. The picture that has been painted is that FOMO-driven buyers are roaming the GTA throwing money at houses, and recklessly bidding without putting any conditions in their offers. Funny enough, this article dropped after I started to draft this blog post, but this is exactly what I'm talking about:

It's true that if you are trying to compete in multiple in multiple offers and your offer has a condition (or two), you're basically bringing a knife to a gun fight. A butter knife. But these buyers aren't going as hog wild as the common perception - at least the perception I've seen in the media, and Twitter. And a search on "Toronto no conditions real estate" quickly turned up several threads in Reddit about it.

Basically this whole situation boils down to one word:

Risk

Or maybe if I pick two words, it's: Risk Mitigation. I look at an important part of my duty of care to my buyer clients is to help reduce risk for them in their purchase transaction. So let's look at the three main types of conditions one sees in offers, and how in-practice the risk factors are greatly reduced with the help of your buyer agent (making the "OMG no conditions" hype overblown).

But first we should talk about...

What is a condition?

Conditions can written into the Agreement of Purchase and Sale (APS), which is the standard OREA form that offers to purchase are made on. It includes the property address, the names of both sides, the dollar amount, and the closing date. What they do is say "I'm offering you this much, on the condition that ____." You then specify a time in which the condition must be satisfied. It's typically 3 to 5 days for most conditions. If the condition isn't satisfied in that time, then the deal dies and both parties move on. If the condition is satisfied, then the deal goes "firm."

If there are no conditions in the offer (also known as a "clean offer"), and it is accepted, then the deal is immediately considered "firm."

Here are the three most common conditions.

1. Financing condition

These could apply to a freehold or condominium purchase. Here is a sample financing condition:

This Offer is conditional upon the Buyer arranging, at the Buyer’s own expense, a new Mortgage satisfactory to the Buyer in the Buyer's sole and absolute discretion. Unless the Buyer gives notice in writing delivered to the Seller personally or in accordance with any other provisions for the delivery of notice in this Agreement of Purchase and Sale or any Schedule thereto not later than 8:00 p.m. on the 30th day of June, 20__ , that this condition is fulfilled, this Offer shall be null and void and the deposit shall be returned to the Buyer in full without deduction. This condition is included for the benefit of the Buyer and may be waived at the Buyer’s sole option by notice in writing to the Seller as aforesaid within the time period stated herein.

2. Home Inspection condition

It's possible to get an inspection in a condominium unit, but it's not very common. There are two main reasons for that: most condo buildings are relatively new (so a 5 year-old building won't have as many potential issues as a 100 year-old house); and the big money expenses on a property (stuff like the roof or the elevator) are covered by the condominium corporation and not the individual unit owner. You are only responsible for what's behind the entry door to your unit. They are also not as common on new or newer houses, partially because some stuff may still be covered under the Tarion Warranty, and also because they'd be built to modern building

Here is a sample inspection condition:

This Offer is conditional upon the inspection of the subject property by a home inspector at the Buyer’s own expense, and the obtaining of a report satisfactory to the Buyer in the Buyer’s sole and absolute discretion. Unless the Buyer gives notice in writing delivered to the Seller personally or in accordance with any other provisions for the delivery of notice in this Agreement of Purchase and Sale or any Schedule thereto not later than 8:00 p.m. on the 30th day of June, 20__ , that this condition is fulfilled, this Offer shall be null and void and the deposit shall be returned to the Buyer in full without deduction. The Seller agrees to co-operate in providing access to the property for the purpose of this inspection. This condition is included for the benefit of the Buyer and may be waived at the Buyer’s sole option by notice in writing to the Seller as aforesaid within the time period stated herein.

3. Status Certificate condition

This applies strictly to condominiums and not at all to freeholds. A note that "freehold" is just an ownership type, not a building style, just like condominium is ownership type, and you can own a condo townhouse or a condo apartment. Freeholds generally take the form of a lowrise house, though, so they're commonly used as synonyms. Here is a sample status certificate condition:

This offer is conditional upon the Buyer and the Buyer’s lawyer reviewing the Status Certificate and Attachments and finding the Status Certificate and Attachments satisfactory in the Buyers and Buyer’s Lawyer’s sole and absolute discretion. The Seller agrees to request at the Seller's expense, the Status Certificate and attachments within 1 days of acceptance of this Offer. Unless the Buyer gives notice in writing to the Seller personally or in accordance with any other provisions for the delivery of notice in this Agreement of Purchase and Sale or any Schedule thereto not later than 8:00 p.m. on the 30th day of June, 20__ , that this condition is fulfilled, this Offer shall be null and void and the deposit shall be returned to the Buyer in full without deduction. This condition is included for the benefit of the Buyer and may be waived at the Buyer’s sole option by notice in writing to the Seller as aforesaid within the time period stated herein.

So from all of this, I'm still seeing that investors are back. Now, will they continue buying up inventory (which has been rapidly declining, at a rate of over 120 listings a week over the last 6 weeks)? Or were they just scooping up old product that might've looked like a deal? Stay tuned...

Those sound important - why would I waive them?

And they are important. But when your agent is telling you that you should waive these conditions in order to be competitive with your offer, they should also be assessing and explaining the risks (and your options) to you. I want to show you how these risks are commonly mitigated.

Mitigating Financing Condition risk

So the risk here is that you buy a place and then can't get a mortgage to pay for it. But you'd still be on the hook for the purchase and would at least lose your deposit if the deal didn't close. That would suck.

That's why when I walk all of my buyer clients through the "Six Steps to Purchasing a Property," step number one is Financing. Or, to get a pre-approval so you know what we're working with here. Because what you can afford is going to colour the neighbourhoods and property types you're looking at. Again, that's step number one. I generally don't take people out to see places unless they've been pre-approved. It's important to understand the difference between being "pre-qualified" and "pre-approved" for a mortgage amount. It's also important to know that a pre-approval does not guarantee a mortgage approval.

I'm going to stop and introduce a word that was big in the days when I was earning my Chartered Accountant (now called CPA, CA) as an auditor at Ernst & Young: assurance. Here are a couple of definitions:

n. A statement or indication that inspires confidence; a guarantee or pledge.

n. Freedom from doubt; certainty about something.

And there are different degrees of assurance. This will be a theme when I'm discussing the waiving of all 3 of these conditions.

So let's talk about financing. Say I've got clients that are a young couple and they have a down payment of $300K to put towards a place (and another pile to cover land transfer taxes and closing costs). Say the bank is willing to lend them $900K. That would mean the maximum purchase price they could afford is $1.2M. But say they're looked at the monthly costs and the most they want to spend is $1 million. I find most of my clients are in this boat, where they don't want to red-line their finances and mortgage to the absolute max that the bank has offered them. So there's some buffer there. There's also buffer in the stress test because that $900K loan amount was based on a 4.79% rate (to be raised to 5.25% on June 1), even though what they're paying will be more like 2.25% on a five-year fixed.

So say they offer on a place for $1 million even. The biggest risk in getting financing is that the bank doesn't appraise the property at what you pay for it. So say the bank comes back and says this place is only worth $940K. They will only loan you 80% of what they think it's worth. So they're only willing to give you a $752K loan on this place. But you've got $300K to put down, so you only needed a $700K loan anyway. So there's no problem; you've still got $52K buffer. So this couple was coming in with a 30% down payment on the property they wanted to buy, so had a lot of buffer. Where it gets tight is the closer you get to having "only" a 20% down payment. That's when you should be considering a financing condition. In this example if they only had $200K to put down and the bank was going to loan them $752K, they'd have to come up with the other $48K somehow before closing in order to complete the deal.

So if a client of mine has a pre-approval, that offers me more assurance than if they just filled out some mortgage calculator online. And if they have a high percentage on hand for a down payment, that also gives me more assurance that a low appraisal won't be a problem. Also, if you have a good relationship with a mortgage broker, and they have a good relationship with an appraiser, you can float the address by them before you put in the offer, to give you a good idea if it's going to appraise or not. I do that when my clients have closer to 20% down. So, there you go, financing condition risk: mitigated.

Mitigating Home Inspection Condition risk

I look at the risk for this condition as being on a continuum:

So the most risk is not getting a home inspection. If you're plunking down a million bucks, it's good to know what you're actually getting for that. Nobody likes surprises. No clients of mine have ever bought a house without reviewing some kind of home inspection.

For less risk, the buyer can rely on a home inspection supplied by the seller, also known as a "pre-listing home inspection." This is what I think what most commentators don't realize. And who knows? These commentators may not have ever bought a property before, or they may live outside of a market where holding offers is commonplace, or who maybe bought their house 10 years ago before pre-list inspections were commonplace. But with the wide majority of houses in Toronto that are "holding offers," the agent or homeowner spring for a pre-list inspection. I can think of one place this year that I had clients interested in that did not have a home inspection. This is to get as many offers to the table as possible, to up the level of competition, which hopefully ups the bidding intensity and the final sales price. Home inspections cost about $500 a pop. If a buyer is in on a house with 10 offers and they pay for their own inspection, there's a 90% chance they just wasted $500, so that's why listing agents spring for them - since buyers may be reluctant to in that situation. I tell my buyers to think of it as part of the acquisition cost of the house, like paying for lawyers, so if you have to spring for 3 inspections in the course of finding a home, you're looking at $1,500 on a $1-point-whatever million dollar property.

I looked up every house priced between $999,000 and $999,999 that's less than a week on market as these ones are likely holding offers. Here's some example language in the broker remarks:

- Please Email X@xyz.com For Home Inspection.

- Fantastic H/I Available.

- Home Inspection Available Upon Request.

- Email X For Pre-Listing Home Inspection.

- Carson Dunlop Home Inspection Available, Email L/A For Full Copy.

- Home Inspection Available *Email X@xyz.com*

I want to note that there is a range of risk in relying on a seller-supplied inspection. This is because home inspectors aren't required to be licensed in Ontario, something I discuss more in this blog post. So if the inspection was done by a reputable company like Carson Dunlop or Pillar To Post then I'm placing more assurance on it than if it was done by Joe's Home Inspections that I've never heard of. As you see, some agents even name drop the reputable firms for that very reason. Further to that, when hen I'm going through my 40-point due diligence checklist for my buyer clients, one thing I check is whether the home inspector is registered with one of the regulating bodies like the Canadian Association of Home & Property Inspectors, or the Ontario Association of Home Inspectors. Both of those websites have a place where you can look up an inspector by name. Members have to pass exams, complete mentoring with peer evaluation, do continuing education and pledge to meet professional and ethical standards (and are subject to discipline). So a report by a licensed or registered home inspector gives me (and more importantly my buyer clients) more assurance than a report by any Joe with a flashlight and a business card. The vast majority of the pre-list inspections I see come from licensed inspectors.

The least risk is of course getting a home inspection paid by a home inspector you hired. It's usually the listing agent that recommends the inspector to the selling client, so they may get many gigs in the course of a year through this agent. That seems to be a conflict of interest. I mean, if they wrote something in the report and the listing agent didn't like it, would they take it out? Or soften the wording? It's possible. This is where ethics and professional standards come in, which is why I place more assurance on the report of a registered inspector. And you'd think that an inspector wouldn't risk their professional reputation for a few hundred bucks. So I'm not saying inspections paid for by the seller are shady; I'm just saying the possibility is higher than if you hire your own.

These buyer-paid inspections (with a corresponding home inspection condition) are totally common in the old fashioned "offers anytime" situation, where you're not in an offer night situation. But it is totally possible for a buyer to spring for one in a multiple offer situation. There's just the chance that they don't ultimately get much value out of it if they are not the "winner" on offer night. Every buyer has this option; it's just up to their own comfort level and risk tolerance. I find most of my clients are satisfied with the seller's pre-list inspection.

Finally, I want to point out that there is no such thing as no risk in a home inspection. They all have limitations due to the fact that they're just visual inspections. They can't punch holes in the wall to look at the wiring, for example. So you're only getting what they can see - though some do further testing with heat guns and moisture meters and most do some electrical testing. Every single home inspection comes with a large disclaimer section noting the limitations.

One exception I'll note here is that sometimes when a house is being listed in "as-is" condition, they don't have an inspection report. This is usually a place that's a "gut job" so they figure you're doing major renovations all over the place so would be updating wiring and repairing any leaks or whatever anyway. Also with "as-is" the sellers generally also won't warrant the condition of things like appliances and the HVAC system, where normally you write in that they agree to hand it over to you in working condition.

Mitigating Status Certificate Condition risk

Let me step back and say what a status certificate is, in case you aren't familiar. When you're looking at buying a property that's got condominium ownership (be it a townhouse or apartment), you can request this document for $100 from the property manager, who will request it from the condo's board. It's usually about a 4-page document that is a snapshot of the "status" of a number of standard items relating to the corporation, the building, and the unit, such as:

- What are the current maintenance fees for this unit? Is the owner up to date on their payments?

- Is the condo corp currently being sued? Are their any outstanding judgments? (What for? For how much)?

- How large is the reserve fun? is that an ample amount? When was the last reserve fund study done?

- Are there any outstanding or planned special assessments?

You also get sent a suite of documents including the corporation's financial statements, the budget, and the building rules (so you can see what pet restrictions there are, for example). For the same reason it's prudent to get a home inspection done before buying a house, it's prudent to have your real estate lawyer review the status certificate before you buying a condo - and that reason is so that you "know what you're getting yourself into." Your lawyer would've reviewed dozens if not hundreds of these before, so are in tune with what you should be looking out for. If it passes muster with the lawyer, then you're good to go. If there are somethings that appear funky to them, they'll explain the risks to you so that you're making an informed decision.

In the "offers anytime" days, it was expected that an offer on a condominium would have a status certificate review clause as above. On the listing agent side, it was common to wait until you had an accepted conditional offer in hand, then they would order the status certificate. It takes up to 10 days to deliver, so there would be a wait and the listing status would show on the MLS as SC (sold conditionally). But we're in different times now and in the first 4 months of 2021, 45% of 416 condominiums sold for over the asking price. So are buyers throwing caution to the wind and not bothering to have a status condition so that their offer is clean? Well, yes and no. They're not putting in those conditions on offer night, but they're not doing that recklessly.

Similar to the pre-listing home inspection, sellers are ordering their status certificate (and related documents) early so that all potential buyers have the opportunity to review it with their lawyers before putting in their offers. I looked up condo listings priced between $499,000 and $499,999 and less than a week on market and here is a sample of the references to it in the brokerage remarks:

- Status Available.

- Status Certificate Available To View.

- Status Certificate Available.

- Status Cert. Available.

- Status Cert Is Available.

- Status Available Upon Request.

You get the gist. Agents are expecting you to review the status before offering so that you can make a "clean" offer.

In summary

Taking the status certificate example, if you don't have the time or make the effort to review like everyone else, than yes your offer will be at a disadvantage. You will have to pay a premium to the seller for them to consider your riskier offer over the other non-risky clean offers. I've heard of several instances where a seller takes less money for a clean offer than one with conditions. I always tell my buyers to look at the seller's perspective, and to them "a bird in hand is worth two in the bush."

So to put your best foot forward in a competitive offer situation, that's why people submit offers with no conditions. But, as you see above, it's not like buyers are being reckless in doing so. The common conditions I've mentioned above are being thoughtfully considered by buyers before they are waived. Any good buyer agent is going to explain the risks to their clients and help them reduce the risks to a level they feel comfortable with (noting every person has their own tolerance for risk) before they offer.

Conclusion: the hype around this is overblown.

Image at top by snowing on Freepik.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot of due diligence work on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment