In the blog last month, I was noting how December condo volumes all of a sudden spiked up and I investigated whether investors were back. (Spoiler: I thought they were.) This month, I'm going to double down on that and look at some of the same things as January's 416 condo sales numbers were record-breaking.

This month I want to also highlight that I set up new charts (20 of them!) that are now responsive so you can hover over any line and find the year and the number for that month (or whatever it is). You'll find them on the Monthly Market Charts page.

Condos think they're really hot!

December 2020 sales set a record at 1,760 condo sales for the 416 (this is apartments and townhouses, but it's around 90% apartments). It beat the old record (December 2016) by 30%, and was 55% above the 10-year average for December.

Well January 2021 was even wilder for sales. The 1.897 sales pounded the old record (January 2017, right on the heels of the old December record) into the ground, topping it by 51%. And it exceeded the 10-year January average by 79%.

So by this measure, condos are certainly hot. "OMG, there's a buying frenzy!"

They're really not (they're not hot)

Let's explore some other measures, as I have "Hot Shot" by Toronto's own Leather Uppers in my mind.

Are prices going wild?

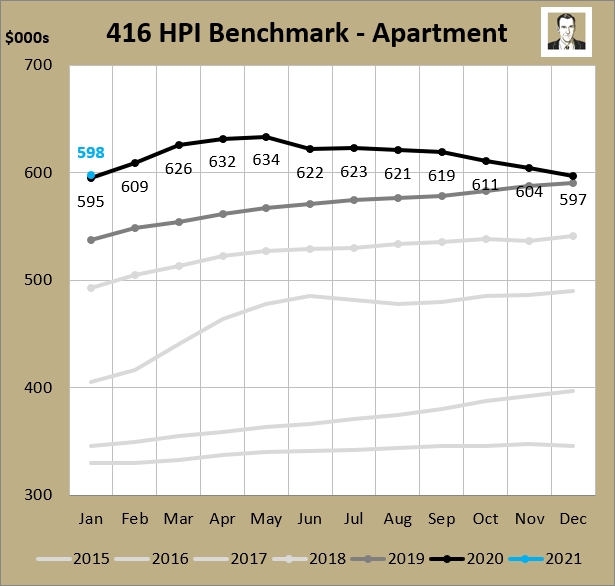

Pretty much same as December and same as last year, so I think that's a slam dunk no.

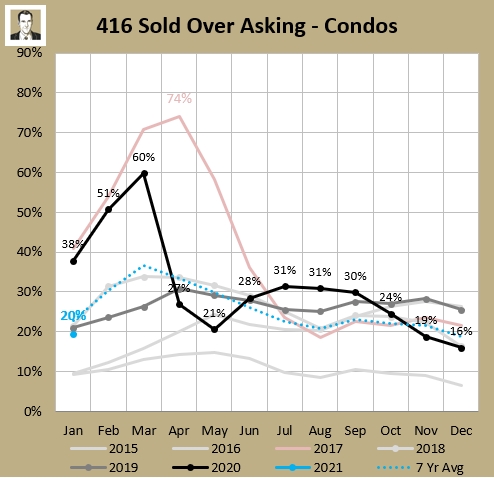

How about sold-over-asking stats? Are people climbing over one another in bidding wars to secure condos?

As you'd maybe guess from the fact that prices aren't growing, that's also a "No." The 20% SOA for January was below the 7-year average of 23%, and the lowest January since 2016, right before condos-as-an-investment really took off with the masses.

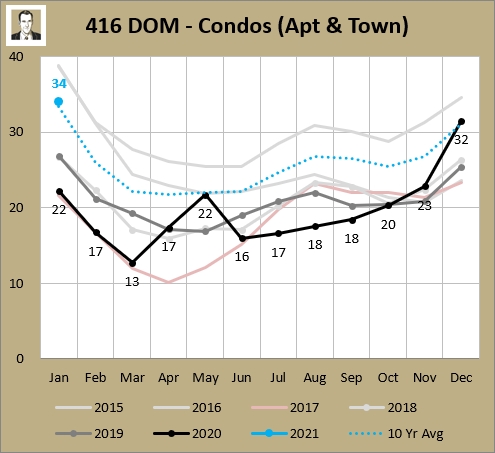

This I find is the most telling statistic: Days On Market (DOM). I find it to be a flawed stat because it doesn't account for re-listings (so not the true time a property was on market) and it doesn't account for stuff that hasn't sold - it only looks at the DOM for the ones that actually sold that month.

The 34 for January this year was the highest January since 2016 and also the highest single month since then (so, 60 months). In between those two January bookends, the 416 condo market's sales have averaged 21 DOM. The 4 previous Januarys averaged 24, so this is a bit of a throwback, as the 6 years from 2011 to 2016 averaged 40 DOM for January. December's 32 DOM was the highest for that month since 2015.

So what I'm taking from this is January (and December) sales were very high as a bunch of investors swooped in to grab old inventory that had been languishing on the market (hence no bidding wars, a high DOM, and not much change in price).

About those condo investors...

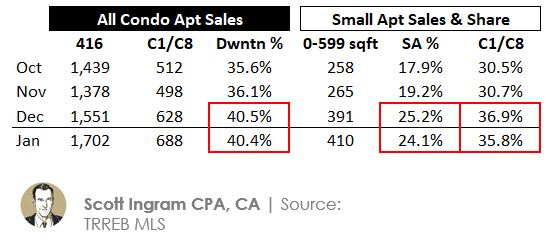

I've updated a chart I prepared last month. It showed the December uptick in sales was also accompanied by in increase in sales downtown (popular for investors), and in in the share of "small apartments" (I was using anything up to 599 sqft).

It indicates January's share of sales downtown in January kept up at December levels, and the share of small apartment sales in 416 and in downtown (TRREB's C1 and C8 zones) also remained at the boosted December levels.

Furthermore I checked the share of 1 bedroom sales (with or without a den) as a percentage of all sales. In October it was 47%, but in December and January it was 55% (November was 52%). The share of the 1 bedroom sales that were downtown jumped from 48.7% in October-November to 51.7% in December-January.

So from all of this, I'm still seeing that investors are back. Now, will they continue buying up inventory (which has been rapidly declining, at a rate of over 120 listings a week over the last 6 weeks)? Or were they just scooping up old product that might've looked like a deal? Stay tuned...

Again, I've got newly-designed market charts up now, and they are available here (as are the historical versions for 2019 and 2020).

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot of due diligence work on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment