I was in a recent Toronto Star article on buying pre-construction condos, and I've been sitting on this data for a long time and meaning to write a post about it. Here's that post, on condo fees being higher in reality than were advertised to you when they sold you your unit.

photo by JasonParis, Creative Commons license

How prevalent is underestimation by developers?

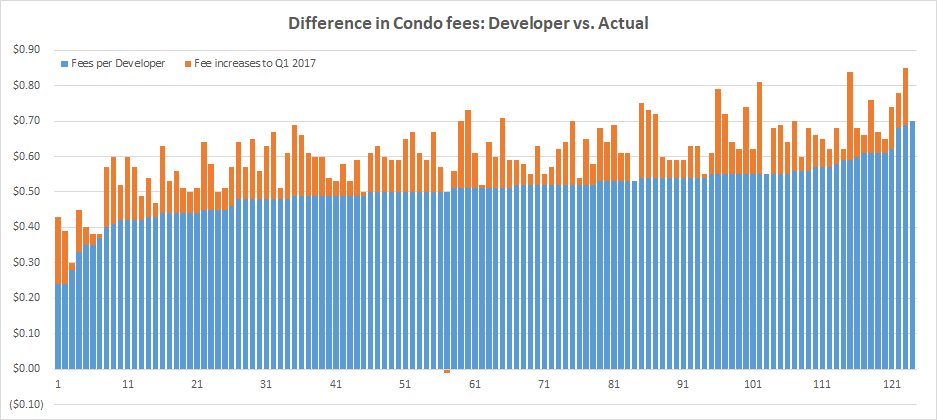

Here's a look at all 124 projects, sorted in order of estimated condo fees from lowest to highest. You can see the only one that came in under estimate is #57 (the negative orange bar). (Larger version here)

To what degree is this understatement?

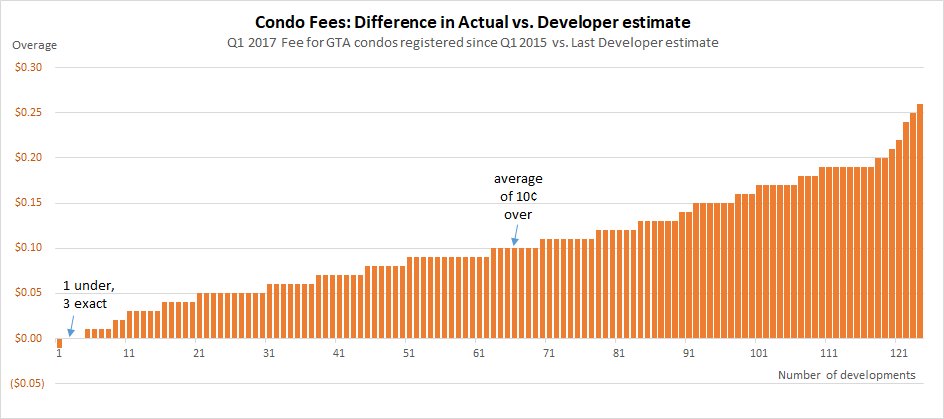

Below I've laid out the projects by the amount the developer's estimate was off by, from smallest to largest. The average project was 10.3 cents off, and 10 cents was also the median. The range was 1 cent under to 26 cents over. (Larger version here)

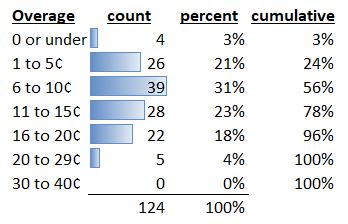

Really you should expect to be off. Of these 124 projects, 104 (84%) were over by 5 cents or more, and exactly half were over by 10 cents or more. More projects were over by 20 cents or more (5) than were on estimate or lower (4). Here is the distribution:

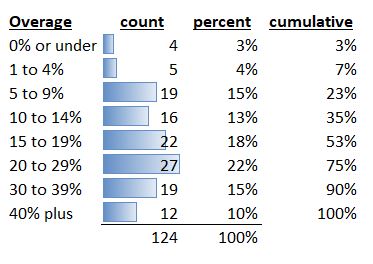

So over half (54%) are in the 6 cents to 15 cents underestimated area. Over 1 in 5 are underestimated by more than 15 cents, so basically you have almost as much chance that they'll be over by 16 cents or more than you do that they'll be accurate within 5 cents. If I group it by percentage over estimate, the distribution looks like this:

Nearly half (47%) were over by 20% or more. The average was 21% and the median was 19%. Twelve projects were over by 40% or more. The worst offenders were Phase I and Phase II of the same low-rise project in Mississauga. The fees for both phases were estimated at $0.24 per square foot ("PSF") and according to the list were $0.39 and $0.43 PSF at Q1 2017, so 63% and 79% over respectively. At least the overage was "only" $0.15 to $0.19 on these ones.

Over the 124 projects, here were the ranges PSF:

Estimated fees - $0.24 minimum to $0.70 maximum, $0.504 average

Actual fees - $0.30 minimum to $0.85 maximum, $0.607 average (20.4% over)

Caveats around the data

Here's a list of potential problems with the data:

• This information was provided to me. I didn't personally vet it to assess its accuracy. It would be hard to go back in time to check the developer estimates, and I can't tell if it they were confirmed every quarter. Plus, the resale condo fees could be based on limited transactions, so might be skewed if the condo board doesn't charge based on square footage (though most do).

• Ideally it would've compared fees at final day-on-sale to fees at registration for each, but now some are a month past registration, and some are two years past

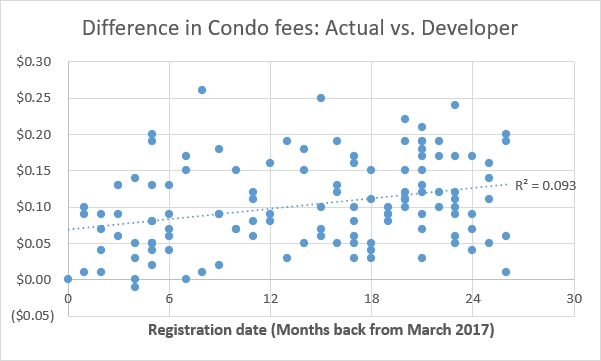

• There may have been been a long period between sell out and registration. The longer out you estimate, the more margin for error. Plus you'd expect costs to increase in that time (though that should be built into the estimate, in theory). Also these 124 projects were completed anytime between January 2015 and March 2017. I suspected that maybe the larger estimate gaps would be for the two year old ones, versus the two month old ones. But when I plotted it out, there wasn't much of a correlation between the registration date and the difference (R squared score of 1.0 would mean a 100% explained, so this is only 9% explained.)

What is my recommendation?

It's pretty clear underestimation is prevalent. With my auditing background, I always approach company statements with a "degree of healthy skepticism." So personally, I'd take whatever fees they estimate and build in a 20% buffer for your own budgeting purposes.

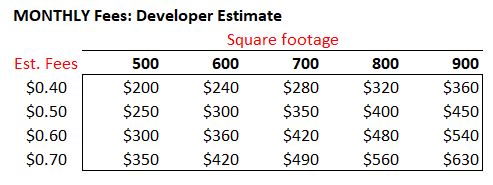

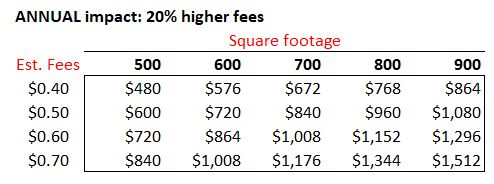

Here is a table I whipped up to quantify the annual impact (i.e. "the buffer"). In this first chart these would be your monthly fees that the developer tells you when you're in their sales office:

So an 800 sqft condo at $0.50 a month would be $400 a month. The second one takes this developer estimate, adds the 20% average overage and multiplies it by 12 months to find the annual impact. For example that $400 a month estimate turns into $480 a month with 20% added on and that extra $80 a month adds up to the $960 below you see over a course of a year.

Other risks in buying pre-construction

I'm not totally against pre-construction condos. I bought one myself and was very happy with it. I will note these risks versus buying a re-sale condo (where what you see is what you get).

- Cancellation (Museum FLTS) - There's a risk your place might not even get built. According to stats in this article 3%-5% of condo projects don't get completed. Since 2012 there have been 23 project cancellations "in the city" according to the same article. By calculations I did, Museum FLTS purchasers got their money back but in 18 months fell $90,000 behind the market (probably more than that because I was using 416 average condo prices and I think this building was more expensive.

- Completion date - If it does get finished, it will likely not be ready for you to move into when they claim it will (build in 12 to 18 months buffer into your expectations)

- Condo fees - Developers are trying to get you to buy their units. What condo are you more likely to buy: one with condo fees at $0.50 PSF or one with $0.60? As above, I'd build in a 20% buffer.

- Unit size - The documents you'll sign say the builder can hand you over a unit that's not exactly what you bought. So you could buy 700 sqft and end up with 680. They're building within allowable tolerances. Also, the way they measure will be more generous (to outside of outside walls and halfway through partition walls) than you would measure (drywall to drywall). Difference due to measurement approach can be in the 10-15% range.

- Building Amenities - The building below at 36 Lisgar ("Edge On Triangle Park") has a "common rooftop deck" between the two towers. Or at least it's supposed to. See how there's nobody in the photo below? That's because, although the building was registered two and a half years ago (April 2015), you're still not allowed to go out there.

- Building Finishes - Check out the two photos below of 202 Bathurst (Origami Lofts). Feel free to LOL at the rendering versus actual. That scaffolding at the base was taken away over a year ago and it's still not finished down there. Notice the renderings conveniently leave out the unsightly overhead streetcar wires? Renderings are fantasy photos, so prepare yourself for some disappointment as the building will end up not looking quite as nice as this ideal view.

The point is that with re-sale condos, at least you can see exactly what you're buying. With pre-construction, there are several risks to be aware of. You're allowed to bring in a realtor to represent you with a pre-construction purchase. They will be paid their commission by the developer, and they will be looking out for your best interests and offering you guidance and hopefully giving you input on the risks that I just listed.

[UPDATE - I went on to write a post dedicated just to pre-con risks, called "12 Risks of buying pre-construction condos" where you can read about the above (in more detail) - and more.]

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment