There's a possibility you've noticed Coronavirus Disease 2019 (COVID-19) is in the news a lot recently. Toronto's real estate market has been going gangbusters so far this year. Obviously COVID-19 is having a much larger global impact, both in terms of countries shutting down, and in terms of financial markets. So I'm not saying SARS and COVID-19 are apples to apples things because you can never look at these things in isolation as so many other factors come into play. That all said, I was curious to see if the SARS outbreak of 2003 had any discernable effects on the Toronto market. Below I share what I found.

Some statistics on SARS and COVID-19

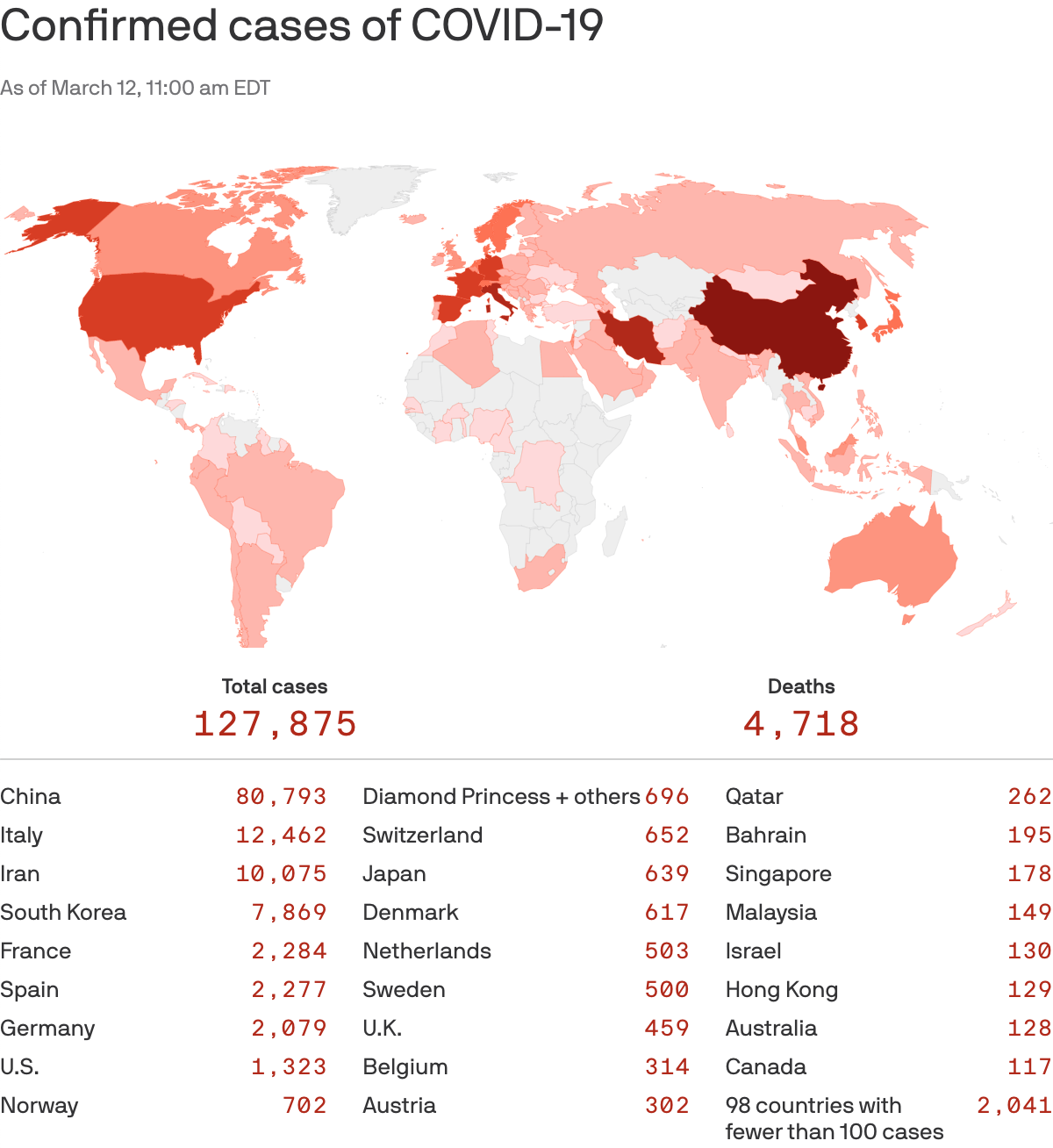

The COVID-19 stats are as of March 12, 2020 and taken from the above map source, Axios. Format below is COVID-19 (SARS):

Countries: 124 (29)

Cases: 127,875 (8,098)

Deaths: 4,718 (774)

Canada cases: 117 (251 or 438)

Canada deaths: 1 (43 or 44)

So COVID-19 is much more global, and with many more cases (and more still to be diagnosed) and deaths. But SARS had a higher death rate (though not everyone with COVID-19 has recovered so that rate is still a bit of a TBD). Of course SARS was a big deal in Toronto because this city was really the major hub in Canada (The New York Times reports 375 of the cases were in Toronto and all 44 of the deaths.)

The timeline for SARS

Nov 16, 2002 - first case of atypical pneumonia is reported in the Guangdong province in southern China

-----

Feb 23, 2003 - 78 year-old woman returned to Toronto from Hong Kong (I'll call her Patient 0 for Toronto)

Feb 25 - Patient 0 develops a high fever

-----

Mar 2 - Patient 0 visits family doctor, now also complaining of muscle aches and a dry cough

Mar 5 - Patient 0 dies at home

Mar 7 - Patient 0's 44 year-old son went to Scarborough Grace, complaining of high fever, severe cough, and difficulty breathing

Mar 12 - World Health Organization (WHO) issues a global alert for a severe form of pneumonia of unknown origin in persons from China, Vietnam, and Hong Kong

Mar 13 - Patient 0's son dies. By this time several other family members were also sick. Health Canada was notified of the Toronto cluster.

Mar 23 - Scarborough Grace closes its emergency and intensive care services

Mar 25 - Ontario goverment designated SARS as a reportable, communicable and virulent disease under the Health Protection and Promotion Act, which allowed public health officials to track infected people and issue orders to prevent them from engaging in activities that might transmit the illness.

Mar 26 - Premier Ernie Eves declared SARS a provincial emergency

-----

Apr 22 - Centers for Disease Control and Prevention (CDC), the leading national public health institute of the US, issues a health alert for travelers to Toronto

Apr 23 - WHO issues travel advisory for Toronto, recommends againts all but essential travel

Apr 30 - WHO lifts Toronto travel advisory, citing 20 days passing since the last cases of community transmission, and noting it doesn't change Toronto's status as an "affected" area

-----

May 20 - CDC lifted the travel alert on Toronto because more than 30 days (or three SARS incubation periods) had elapsed since the date of onset of symptoms for the last reported case

May 23 - CDC reinstated travel alert for Toronto because on May 22, Canadian health officials reported a cluster of five new probable SARS cases.

-----

Jun 27 - SARSfest tickets go on sale (official name Molson Canadian Rocks for Toronto) with the Rolling Stones headlining and tickets at $21.50(!)

-----

Jul 5 - WHO announced global SARS outbreak was contained

Jul 30 - SARSfest happens, with 450,000 to 500,000 people attending the day-long concert at Downsview park

Photo via Luminous Communications Group on Pinterest

SARS' effect on Toronto real estate

Okay, now that we see the timeline, stuff started really breaking in the news in March 2003 and was mainly done by May and officially done by July when the WHO announced it had been contained.

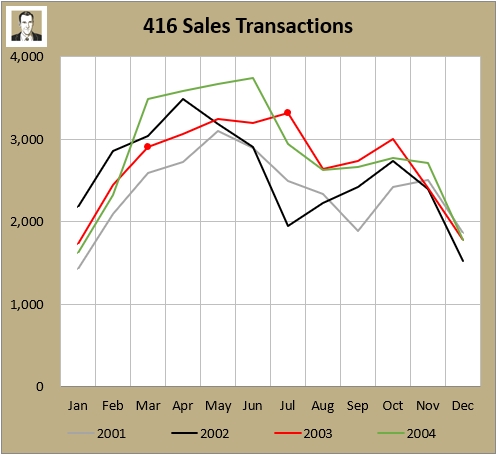

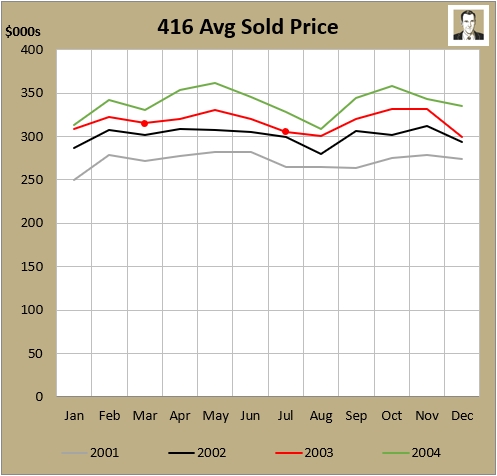

First a look at sales. These are for freeholds and condos, but just for the 416 (not the whole GTA). I've got the SARS year, 2003, in red, and then a couple of years leading up to 2003 (grey and black), then the year after (in green). The dots I put on to highlight the start (March) and end (July).

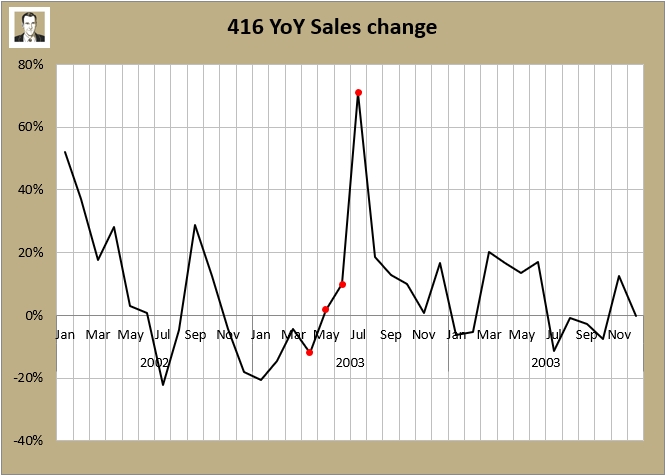

The first couple of months of 2003 were already below 2002 for sales transactions. So the fact March and April were below doesn't seem to tell me anything. Then May, June, and July were up over 2003 (July was particularly strong in this 4-year view). On a year-over-year (YoY) percentage basis it also doesn't seem to have any ill effects in the March to July period, with 4 of those 5 months increasing over the prior months on a percentage basis.

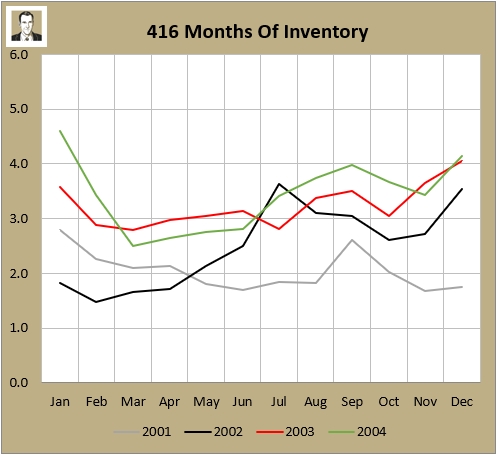

How about a look at months of inventory (MOI) to see if the market softened and became more of a buyer's market in this time?

Again I'm not seeing much. It's true that the 5 months in question had a higher average MOI (3.0) than the other years (2.8 for 2004, 2.3 for 2002, 1.9 for 2001) but again it started higher in Jan and Feb anyway. Plus it only varied by 0.3 months in that time, while 2002 increased by 1.9 in that same 5 month period, and 2004 by 0.9.

Lastly, a look at average prices:

They remained above 2002 levels for all the focus months. It's true the July price was lower than the March price by $10K, but all four years on here were lower in July versus March so it's not a strange thing. And prices climbed again in the fall, but they always climb again in the fall (with a larger mix of houses versus condos being sold).

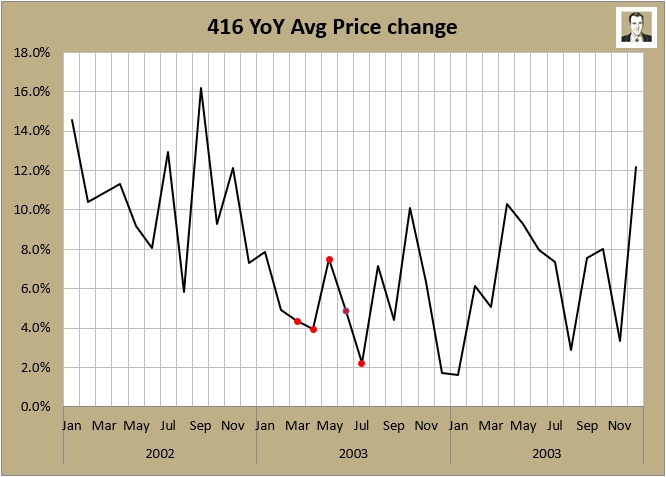

I looked at the YoY change and it's true that price increases decelarated in March and April, but you can clearly see they'd been falling a lot already since the 16.2% peak in September 2002.

Conclusion

Nothing jumped out at me in any of these charts to say to me that SARS had any discernable effect on the Toronto real estate market statistics during the course of the epidemic's run in 2003. But nothing happens in isolation, and as I mentioned, COVID-19 has already brought down the financial markets and it looks like a recession will be upon us shortly, so we're not talking apples to apples here. It's unusual that people have lost confidence in the financial markets but not the real estate market. Or maybe it's not, because people might be looking at real estate as some sort of "safter investment." Again, lots of forces at play; I just wanted to have a look at 2003 to see if anything jumped out at me. Nothing did.

Information Sources

SARS stats: https://en.wikipedia.org/wiki/Severe_acute_respiratory_syndrome, https://globalnews.ca/news/6458609/looking-back-toronto-sars-outbreak/, https://www.cdc.gov/about/history/sars/timeline.htm

COVID-19 stats: https://www.axios.com/coronavirus-latest-developments-8b8990c4-6762-494a-8ee0-5091746bda9b.html

SARS timeline: https://www.cdc.gov/about/history/sars/timeline.htm, https://globalnews.ca/news/6458609/looking-back-toronto-sars-outbreak/

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment