These are wild times. New proclamations are coming out seemingly daily from all levels of government, with the latest (at time of writing) being the Ontario government closing all non-essential businesses as at 11:59 PM Tuesday. I'm getting clients, people on my social media, and friends and relatives reaching out and asking me what affect I think it will have on Toronto's real estate market. So I figured I should write this blog post. (In earlier days, I took a look at whether the 2003 SARS outbreak affected the Toronto real estate market or not.)

Level 1: Organized Real Estate

That is the term they use for the official bodies representing realtors. Practially all agents in Toronto are members of the Toronto Regional Real Estate Board (TRREB), the Ontario Real Estate Association (OREA), and have to abide by rules enforced by the Real Estate Council of Ontario (RECO). Mirroring what the government levels were doing, all of these bodies have escalated their responses as far as what members should or shouldn't be doing. And have closed their own doors to outsiders.

Particularly with TRREB you can see they keep issuing updated pronouncements with escalated measures as they try to play catch-up instead of getting out in front.

OREA has it front-and-centre, and you can see they've cancelled classroom courses (many can be done online), and exams too (which were done in computer labs and envigilated):

RECO's doors are also closed, and the COVID-19 related notices are easy to spot (the latest is "We strongly recommend that brokerages and salespeople follow the direction of health officials by declining to facilitate or participate in open houses, and by limiting showings to where they are absolutely necessary.")

Level 2: Brokerages

First of all, here's a re-cap the hieararchy, there are real estate companies like Century 21 or Remax. Then they often franchise out brokerages, for example my office is Century 21 Regal Realty Inc., Brokerage. Each of those has a Broker of Record who is ultimately responsible for all the transactions that go through that brokerage. There are smaller regional or local brokerages, for example Bosley Real Esate Ltd., Brokerage. Then these brokerages have a bunch of agents that go out and transact, with the brokerage ultimately handling the paperwork and compliance.

So earlier in this crisis, a lot of stuff was left in the hands of the brokerages to dictate, and different offices used their own judgment to direct their agent roster. Now with the recent escalated Organized Real Estate pronouncements, much is out of their hands.

From an administrative point of view, I was in my office on Monday to pick up my paper RECO license (which is a must to have in my wallet) and they were scrubbing down all surfaces. And I know my Broker of Record has been hard at work staying on top of this as we have been getting frequent updates from her. She recently sent around an attachment for the MLS listing that lists all of the showing procedures to follow (e.g. no double bookings, nobody that recently traveled can enter, etc.), as well as a sign to display at the property that reinforces all of those things the viewers acknowledge before they enter.

Level 3: Agents

Okay so this one is at the agent's own comfort level, and I guess their activity level and timing of that activity. I work from home and live alone so really I haven't noticed much difference in my day-to-day. (Work-wise, anyway. Outside of work I'm affected like everyone else: the recreational sports I play have been cancelled, I'm not going out to rock shows or the movies or meeting friends for dinner. But my work day isn't remarkably different.)

In the midst of all of this COVID-19 activity, I happened to have a couple of listings scheduled to come out shortly, and usually the most work happens before the listing hits the market. Here are the two places I was working on getting out:

1) A large one-plus-den condo loft that has tenants. The owner and I first met in the fall to discuss listing. They had moved out of town and kept it as a rental for a couple of years but decided earlier this year that they'd sell in the spring. Back when things were more normal, we had set a target listing date for Monday March 23rd (this week). This condo listing is now on pause.

2) A nice detached house off the Danforth. The owner and I first met in the fall to discuss listing. They were completing a kitchen renovation at the time. They were living between two places and decided the time had come to sell the city property. In earlier, calmer times we had set an optimal listing date of Wednesday April 1 (next week). Progress on this listing has been slowed. A lof of that has to do with my next section...

Suppliers ![]()

![]()

![]()

Because I was co-ordinating a lot of things with respect to the two listings, I've been speaking with several people representing many different real estate related businesses. I thought I would shae are a few things I've heard directly from them. Some of these conversations were a week or so ago and as you know things are changing daily.

Home Inspector: Demand for his business was, as he classified it, "all over the place." Three weeks ago he did 15 inspections, two weeks ago it dropped to 2, and then last week when I spoke to him he had 7 scheduled for the week. In there would be some buyer inspections for conditional sales and some pre-listing home inspections (why I reached out), but I'm not privvy to the mix. He did say he was getting last minute cancellations.

Home Stager: They had a couple of cancellations. If the market slows down, having staging is a risky proposition for sellers because the fees usually include rental of the furniture, etc. for 30 days. Usually selling a place in 30 days isn't that difficult in Toronto (unless it's a really high price point). Beyond that initial 30 days, you have to roll into another 30 day period, which they usually give you a discount for (e.g. 25% off additional months).

Window Washers: They would only give me a quote for exterior windows, saying they had suspended their internal window washing activities for now.

Roofer: They were unaffected as far as giving a quote because they could just take their ladder and go up on the roof and not have to deal with anyone. As far as working, there was still a small crew but at least they were all working outside and could practise social distancing where possible.

Gardener: It was a husband and wife team and they were outside and did not need to come into contact with anyone else at the house (they did go out to the store to get some mulch).

Electrician: They asked if anyone would be home while they came in, and that was their preference.

Handyman: One has been working away at the house a few hours here and there, first visiting in February. As such he's not so intimidated by the house, nor the owners. So he's continuing to go, and just social distancing when the owners are around, and he brought some wipes for after he touches a light switch or something.

Floor Plans: One came around the house early last week before a state of emergency was declared. At that point he had only had one cancellation. The condo sale I'm working in conjuction with another agent so we're using some of his contacts. The person who did the condo floor plans measured while nobody was there.

Photographers: My primary photographer said they were suspending operations for the time being and cancelled the scheduled March 31 house photo shoot two weeks out. The original photographer for the condo wasn't feeling well on the day of the shoot, so the company sent out someone else instead. My partner on this sale let them in to do their business but then steered well clear, then locked up afterwards.

So you can see it's a bit of a mix, and different individuals have different comfort levels with being around others or being in a stranger's home. It will be interesting to see what the Ontario government deems to be an "essential service". So those are some updates from me in the field from the last couple of weeks, but I'm also wondering about the following corners of the industry:

Lawyer: A buyer client of mine closed last Monday on March 16th, which seems like forever ago. The client knew their own lawyer was working, but had some fears the seller's lawyer might not be. But it turns out they were, and the deal closed smoothly with no problems. But what a difference a week makes in this current situation, and I don't know what most lawyers are doing right now. Many lawyers still like you to go in and sign some documents in person. While I can see lawyers being able to work from home and have some workarounds, what I can see being a barrier is the...

Land Registry Office: There are 66 Land Registry Offices across the province. If these shut down, then I would suspect the whole system would grind to a close. Then when it opens up you would have to think there will be a major backlog. [UPDATE: #67 on the list of essential services was "Land registration services, and real estate agent services and moving services."]

Lenders: I would think most mortgage brokers have the capability to work remotely. I'm sure some representatives of lenders can access what they need to remotely. I'm not sure about underwriters. Maybe they have to go in to an office to access the systems or something. Anyway, when things close, the lawyers have to work in conjuction with the lender to make sure the buyer's money is transferred to the seller, via the lawyers.

Appraisers: Before the lender releases the funds, they want to be sure on the value of the house they're lending against. Sometimes appraisals can be done online, but I know sometimes real people are still sent out to walk through the property and check it out first hand. With some people uncomfortable with, or refusing to enter enclosed environments they're not familiar with, will this present a problem with appraisals (and therefor loans)?

The Crystal Ball ![]()

Nobody knows what's going to happen with the pandemic, let alone the economy and the real estate market. I think it's pretty safe to say a recession is likely, and it could be a severe one. That can't help the housing market. There will be would-be buyers that will be laid-off. They won't be able to get a loan until they've got a new job - and beyond that lenders like you to be clear of your probationary period (often 3 months). And you figure there will be some extended homeowners that won't be able to afford their mortgage payments and may be forced to sell. Both of those are headwinds for the real estate market (reduced demand, increased supply). I can't see a way demand will be increased in the near to mid term (the recent interest rate cuts are ony going to help people that still have jobs).

If people aren't going out to look at houses, I don't think they'll be buying houses. Checking in with my own clients I've seen a few different reasons they're taking their foot off the gas currently:

- don't want to go out of the house (and into the homes of others)

- lost some money in the market which affected down payment so want to do some more saving (Note: if you're purchasing imminently I always advise having your money in low risk stuff)

- waiting it out to see if prices drop

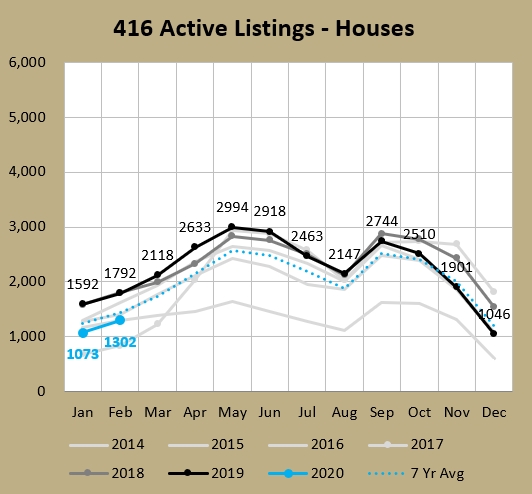

I see lower demand as a bigger factor than increased supply in the near term, because we're starting with such low inventory numbers to begin with.

However, you can see above that inventory happened to shoot up really quickly in 2017. For freeholds the supply numbers only went back to recent ranges (though on the high end), but the quick change in months of inventory ended up dropping average prices.

The next 3 months

Here are my predictions of what we'll see in the next 3 months. It's all speculation on my part, but all anyone can do is guess.

416 Freeholds:

Sales volumes will drop. Some buyers will shelve their searches, for the reasons I mentioned above with my own clients. Average prices will fall. I'm predicting the entry level of the market will remain bouyant because there are still way more buyers than sellers in that space. But I believe higher priced houses will be pulled off the market, and the average days on market (DOM) will probably increase for those listed. Because more entry level and less higher level houses will sell, the average price will go down. I encourage you to pay more attention to the Home Price Index (HPI) in the coming months, as that just tracks a consistent benchmark home so doesn't get distorted by mix. I don't think the HPI will move much (though a bit down if any direction).

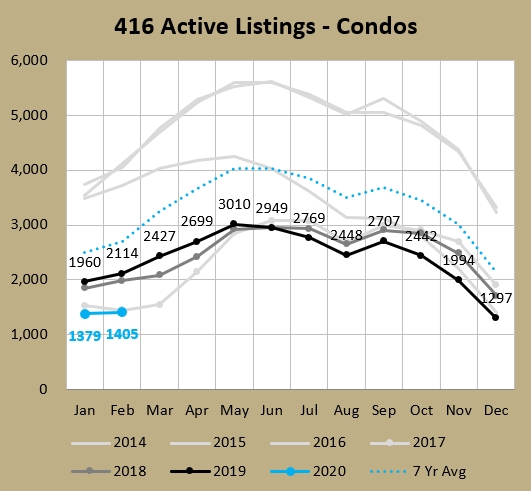

416 Condos:

Sales volumes will drop, for the same reasons as above. Supply will rise. There are a lot of investors out there. I've long maintained that the next recession was going to be harder on condos because many "investors" are cash flow negative. It's not so bad coming up with a few hundred extra bucks a month when you're gainfully employed, but what about if you lose your job and things tighten up in a hurry? There may be some sales out of necessity. Especially for the owners using their condos as Airbnb ghost hotels. Talk about cashflow negative - with travel ground to a halt the inflows are ZERO right now. There is a lot of chatter online about a surge of condo units hitting the resale market and rental market. While some of these investors will list more out of necessity, I think you'll see others list because they want to cash out while they're up a lot. And as you saw there with toilet paper, once the sheep start stampeding, it can be hard to reign them in. I'm not saying things will collapse in the condo market, but I can say there has been a lot more greed in that market segment. And greed is not good. This one will be interesting because the entry-level condo segment ($400K to $500K or even under $600K now) was the tighest segment of the 416 market. Lots of demand. So this should at a minimum bring some more balance back to things. I still think we'll see the average price go down, due to a big of flooding of lower priced inventory, but I don't anticipate much movement in the HPI.

The longer term

As far as predicting longer term goes, with things changing daily it's really difficult to forecast. But the one thing that has been pretty consistent is that for the most part people have been underestimating things. We didn't go straight to a state of emergency, but stepped up to that point. I think this recession has a chance to be pretty ugly. I know many of these emergency measures (deferred rent and taxes, etc.) and the large jumps in unemployment are unprecedented in my lifetime, and likely beyond. And in that scenario it's hard to imagine strong demand for housing, especially coupled with looming uncertainty and low consumer confidence. So it's very conceivable that prices will drop. As one of my Twitter followers mentioned, with basically all assets devalued, it's hard to imagine house prices not dropping.

416 freeholds

With freeholds, I think it's safe to say flipping should dry up for awhile. First of all timelines might be drawn out on the construction side (harder to get labour crews, could be supply shortages). Secondly, houses may take longer to sell. Thirdly, if prices are dropping, that's shrinking margins as well. It all adds up to a lot more risk, which should make this segment unattractive. I also think we may see less foreign buyers for the time being. Although my understanding is that lot of foreign buying occurs sight-unseen, you'd think there will be travel limitations, plus with stock markets down worldwide, people have less money to invest in other places. Then again, maybe people double down on the "real estate is a safe haven" mindset.

416 condos

Similar stuff I mentioned in the 3 month look applies. I think investor demand will slow right down. A lot of factors (large increases in rental listings were already happening before vacant Airbnbs were thrown on the long term rental market recently, and we know Airbnb measures banning ghost hotels were coming this year anyway which should further increase supply) are pointing to cheaper rent. In fact, a new report shows one bedroom rents in Toronto in February are down slightly year-over-year and down 3.2% from January. We've also got calls for a rent strike with one petition calling for the the government to suspend payment to pay rent having over half a million signaturs. Oh, and evictions are currently banned. Who wants to become a landlord in that environment? Plus the largest reason people were buying these investment condos was for the capital appreciation. Nobody is buying thinking of the risk of prices going down because they only go up, right?

Add to that the record 29,500 condo completions scheduled in the GTA for this year. (These seems likely to come down due to so many people not leaving homes now.) Now a lot of those will go to end-users that will move into them. But half of the ones in the 416 were likely purchased with the intent of renting out. So add those to the supply of rental apartments I already talked about going up above. Doesn't look good for rent prices. Some will likely want to cash out ASAP, adding to the resale supply. And of course add in a lot of unemployment. I can't see any much of a case for increased demand or tightening supply in the mid-term, but the opposite is easy to see.

The next two months of statistics will be very interesting to watch. March will only partially be under the specter of COVID-19 and things have just begun to shift. So April will be the really interesting one to see.

About Scott Ingram CPA, CA, MBA

Would you like to make better-informed real estate decisions? I believe knowledge is power. For that reason I invest a lot of time researching and analyzing data and trends in the Toronto real estate market. My Chartered Accountant (CPA, CA) side also compels me to perform a lot more due diligence on properties my clients are interested in purchasing. If you have better information, you should have less risk and be in a position to make better decisions for your hundreds of thousands of dollars.

Your home is the single largest investment you'll make - trust it with an accountant.

Post a comment